Alternative payments dominate India’s e-commerce payments

Mobile and digital wallets make up 58.1% of all e-commerce payments in 2023.

Alternative payments now make up almost 6 in 10 e-commerce payments in India, says data and analytics firm GlobalData.

Mobile and digital wallets, alongside other alternative payment methods, have displaced cash and cards to make up 58.1% of the market share in 2023.

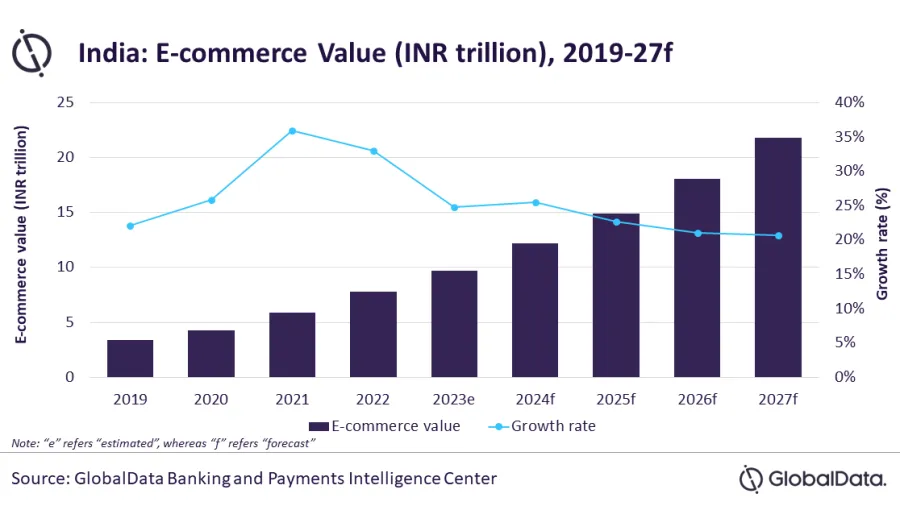

India’s e-commerce market is set to be worth $117.3b in 2023, rising by a compound annual growth rate (CAGR) 28.2% from 2018.

E-commerce payments, meanwhile, are forecast to grow at a CAGR of 22.4% between 2023 and 2027 to reach $263.6b in 2027.

ALSO READ: National Payments Corporation of India, Fonepay tie up for cross-border QR-code

GlobalData said that this was driven by the rising internet and smartphone penetration, discounts, faster delivery options offered by online retailers, and the growing consumer preference for online shopping.

The Indian government also launched initiatives such as Startup India and Digital India, which also contributed to overall ecommerce growth.

“The uptrend in e-commerce sales in India is likely to continue over the next few years supported by the growing consumer preference, improving payment infrastructure, and growing popularity of alternative payment solutions with these solutions dominating the ecommerce payment space over the next few years,” Ravi Sharma, lead banking and payments analyst at GlobalData.

Advertise

Advertise