Chart of the Week: 1 in 4 Filipinos have used BNPL services

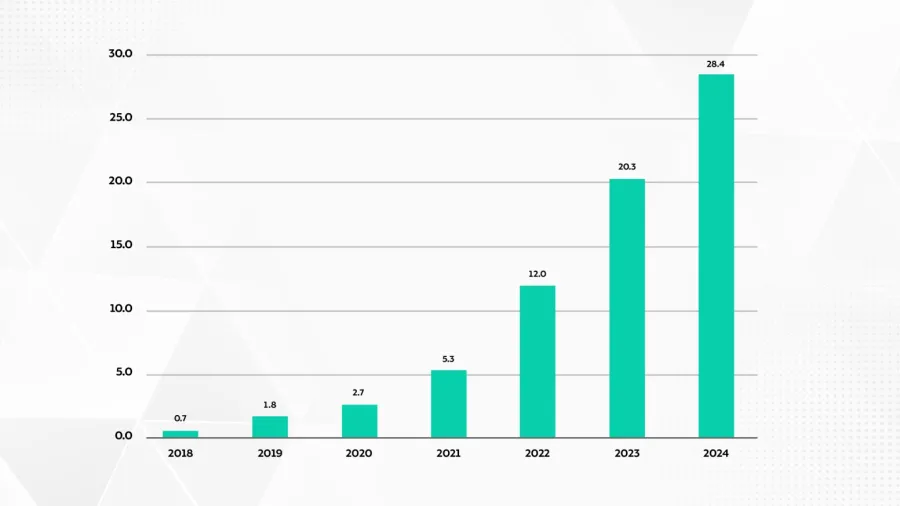

The number of unique users rose by 40% as of end-2024.

About 28.4 million Filipinos have used buy now pay later (BNPL) services by end-2024, according to data from UnaCash.

This is 40% higher than the 20.3 million unique users reported as of end-2023.

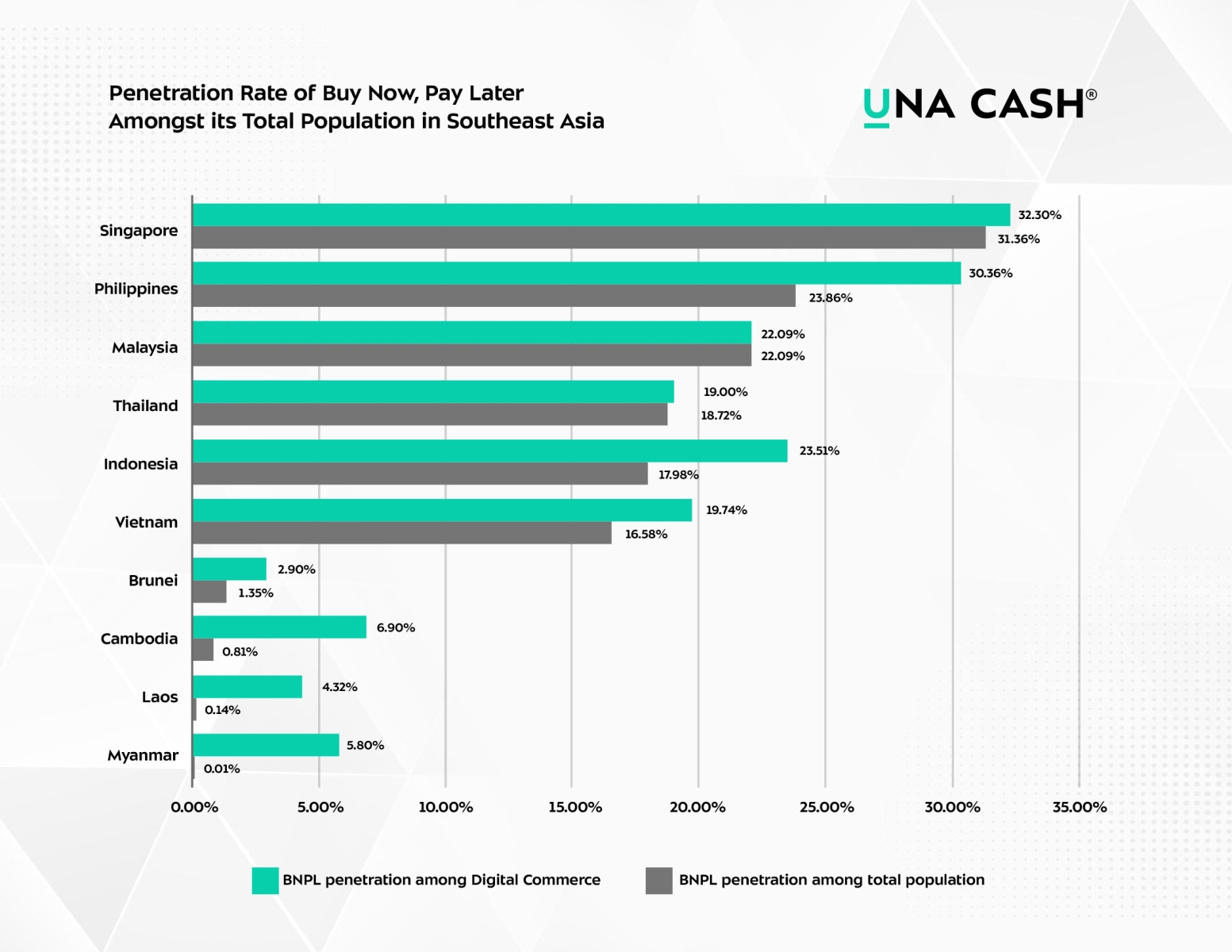

This makes the Philippines the second-ranked country in terms of BNPL penetration rate amongst its total population, behind Singapore, which has a 31.36% penetration rate or 1.9 million users out of its 6.05 total population. Malaysia, Thailand, and Indonesia followed.

“Filipinos are clearly embracing the flexibility and convenience that buy now, pay later services offer, and businesses are embracing this critical strategy to enhance customer accessibility and satisfaction,” said Erwin Ocampo, head of product for UnaCash.

UnaCash estimates an increase of BNPL usage in the Philippines by 28.39% among the total population at the end of 2025.

Advertise

Advertise