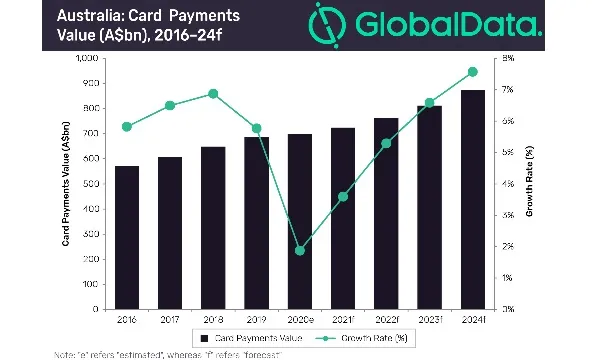

Chart of the Week: Australia's card payments to grow 5% CAGR in 2019-2024

Even small merchants are now pivoting to cashless payments, says GlobalData.

The value of card payments in Australia is estimated to grow at a compound annual growth rate (CAGR) of 5% between 2019 and 2024, according to revised estimates by data and analytics company GlobalData. In contrast, ATM cash withdrawals are expected to contract 3.5% over the same period.

Card payments are expected to rise as Australia begins to ease lockdown restrictions, and a rise in consumer and commercial spending is expected, noted Ravi Sharma, banking and payments lead analyst at GlobalData.

The growth in card payments will also be driven by rise in contactless payments. Australia is one of the most developed contactless card markets in the world with a majority of consumers using contactless cards, he added.

As a result of the coronavirus pandemic, the use of contactless cards is expected to increase as even smaller merchants are now insisting on non-cash and contactless payments.

“Australia is a well-developed payment market with robust payment infrastructure, high banked population, and high usage of contactless payments. Whilst [the] payments market growth was hampered by the recent COVID-19 outbreak, it is expected to revive with the gradual easing of lockdown restrictions,” Sharma concluded.

Advertise

Advertise