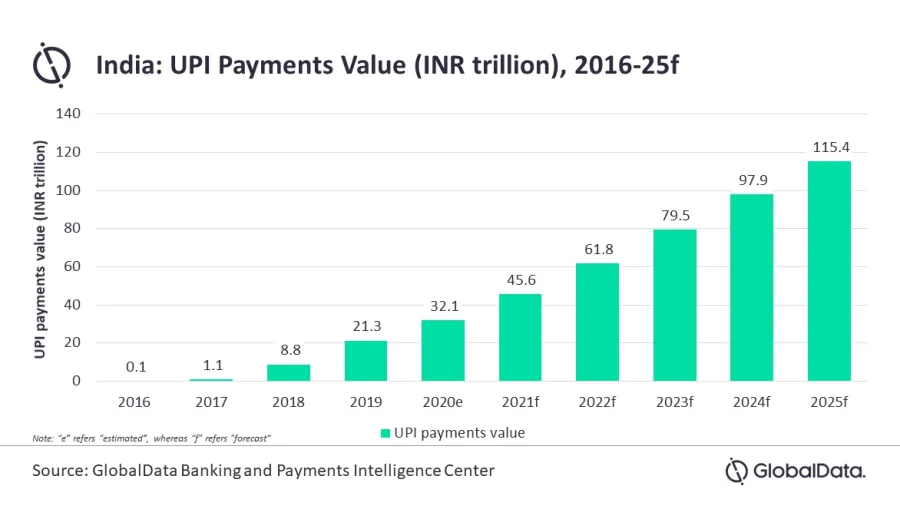

Chart of the Week: India's payments via UPI to reach $1.7t in 2025

The entrance of WeChat Pay is expected to intensify competition in the payments space.

India’s payments using the Unified Payments Interface (UPI) system is expected to reach $1.7t in 2025, according to a report from data and analytics firm GlobalData.

For 2019, UPI payments totalled $306.3b, growing at an exponential compound annual growth rate (CAGR) of 574.5% from 2016’s $1b (INR69.5b), when it was first launched.

Since its launch just four years ago, UPI has become a preferred day-to-day payments mode in India. The system allows customers to integrate bank account with mobile payment solution and enables instant transfers between bank accounts from mobile phone using virtual ID, mobile number or QR code, making transactions quicker.

The trend further gained momentum during the COVID-19 pandemic as consumers prefer to use non-cash payment method. UPI transactions have breached the two-billion mark per month in October 2020.

“The COVID-19 pandemic has introduced several first-time users to digital payments, further contributing to the growth. UPI is gradually becoming an alternative to cash and traditional bank transfers. Rising banked population, high smartphone penetration, proliferation of UPI-enabled mobile payment brands are some factors driving the growth,” said Nikhil Reddy, banking and payments analyst at GlobalData.

This benefits third-party mobile payment brands such as PhonePe and Google Pay. Against this backdrop, the entry of WhatsApp Pay is expected to further drive competition in the Indian payment space, noted GlobalData.

The popular social media platform is expected to benefit from its large user base of over 400 million.

WhatsApp, which started testing beta version of its payment service in February 2018, received approval from the National Payments Corporation of India (NPCI) in November 2020 to roll out its digital payment solution on UPI platform in a phased manner to a maximum of 20 million customers.

“The widespread QR code infrastructure in the country coupled with its large user base provides WhatsApp an opportunity to position itself in the highly competitive Indian consumer payment space,” Reddy said.

However, he noted that it will likely take time for WhatsApp to replicate the success story of China-based WeChat Pay, payment solution offered by social media app, WeChat.

Advertise

Advertise