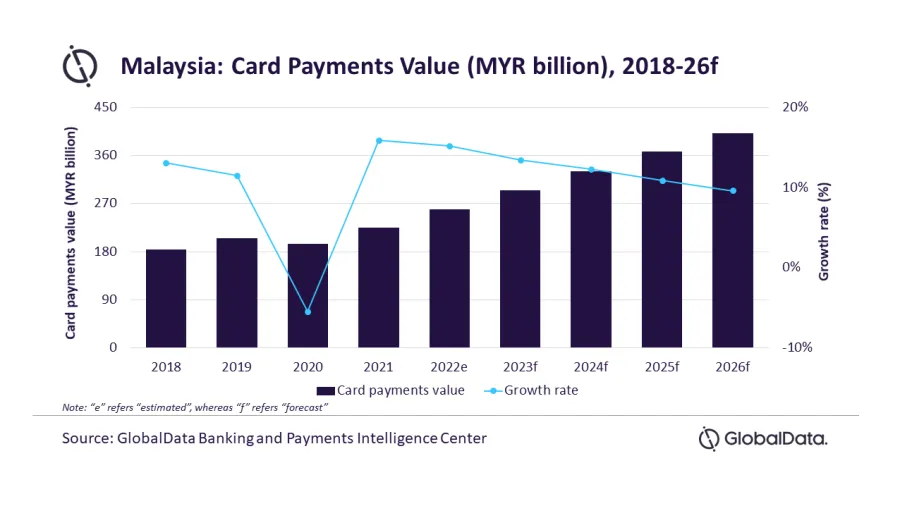

Malaysia’s card payment market value to grow 15.2% in 2022

A perfect storm for card adoption is brewing in the country.

Malaysia’s card payments market is expected to grow 15.2% in 2022, thanks to a rise in consumer spending, local financial inclusion measures, and growing preference for contactless payments, according to data and analytics company GlobalData.

This extends the 15.9% rebound in 2021, following a 5.4% decline in 2020. From 2022 to 2026, market value is forecasted to grow at a compound annual growth rate (CAGR) of 11.5% and be worth US$95.6b by 2026.

Several factors are brewing up a perfect storm for the growth of the card payments market in Malaysia. Notably, the government recently awarded five digital bank licenses, which are expected to launch over the next two years. The neobanks are expected to to complement traditional banks and increase financial inclusion in the country, and GlobalData expects that they will in turn push card penetration and payment card usage.

ALSO READ: Malaysia’s new digital banks fated to remain niche in medium term

The central bank is also looking to reduce interchange fees to encourage card acceptance amongst merchants. As of December 2021, they’ve proposed for interchange fees on debit cards to be reduced by 0.1% from 0.15% previously, and on credit cards 1.1% prior to 0.6%.

An increasing number of consumers are also now looking for ‘touch-free’ payments, thereby pushing the usage of contactless cards. According to the Bank Negara Malaysia, two out of every three card payments at physical stores in 2021 were contactless, compared to one out of two in 2020.

Advertise

Advertise