Mobile wallet payments in India to hit $5.7t in 2027

The value of mobile wallet payments doubled from 2018 to 2022.

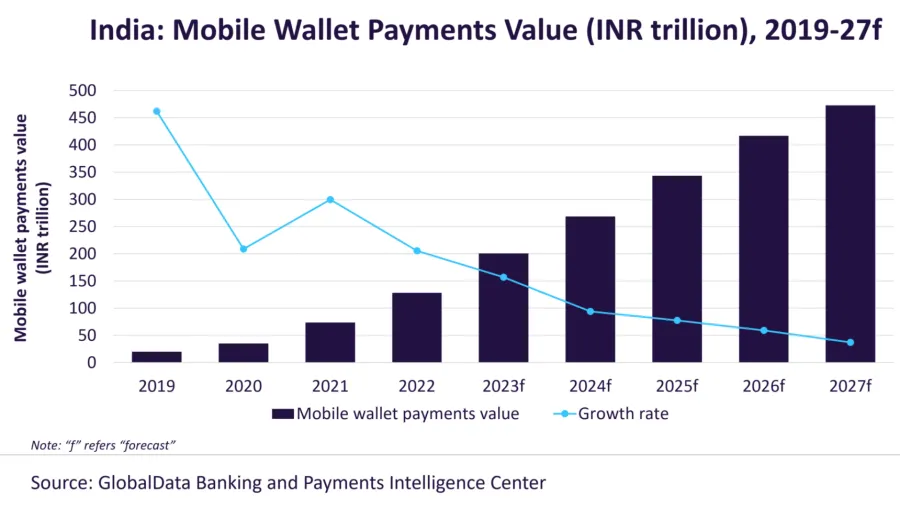

Payments in India made through mobile wallets are expected to reach $5.7t in 2027, expanding at a compound annual growth rate or CAGR of 23.9% between 2023 and 2027, according to forecasts by data and analytics company GlobalData.

The value of mobile wallet payments have doubled between 2018 and 2022, growing at a CAGR of 102.7% to reach $1.5t (INR128.2t) by the end of the period.

High adoption of the UPI and QR code payments has helped push the adoption of mobile wallets amongst Indian customers.

UPI has reportedly become one of the most preferred payment methods in India. Launched by the National Payments Corporation of India (NPCI), UPI allows customers to integrate bank accounts with a mobile payment solution and enables instant money transfers.

The Reserve Bank of Indian (RBI) has also made mobile wallet interoperability mandatory beginning 1 April 2022, enabling users to make QR code-based payments irrespective of the QR code solution used by the merchant.

Advertise

Advertise