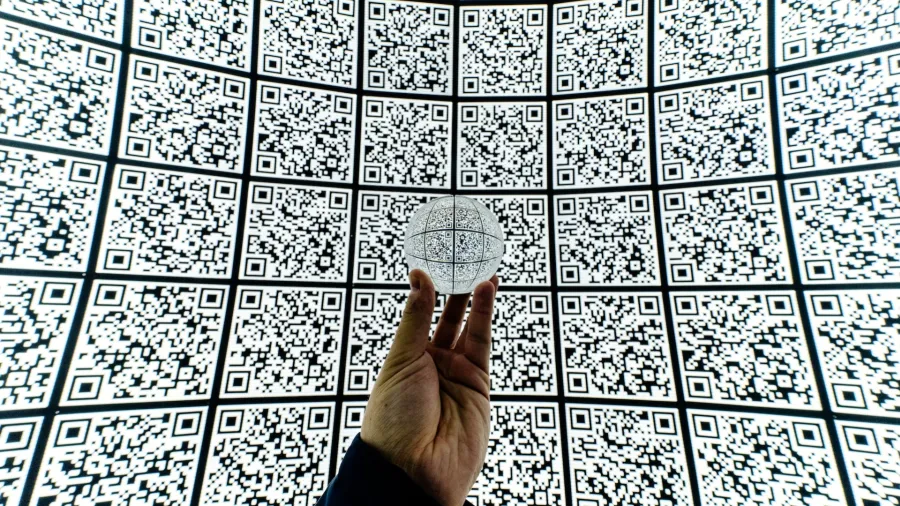

QR codes and low costs drive mobile wallet adoption in APAC

Even cash focused countries like the Philippines, Thailand, and Malaysia saw a high level of adoption.

Mobile wallets are rising in popularity in Asia Pacific on the back of an accelerated consumer shift towards non-cash payment methods such as QR codes, reports GlobalData.

Its low cost and the high adoption of QR code-based payments have been a major driver, said Shivani Gupta, senior banking and payments analyst at GlobalData.

“This trend is driven by the availability of low-cost smartphones, increasing internet penetration, growing awareness of mobile payments, and the proliferation of mobile wallets and QR code-based payment solutions,” Gupta said.

The costs associated with mobile wallet acceptance, including setting up infrastructure and transaction fees, are much lower compared to traditional card-based payment systems, GlobalData noted.

Even traditional cash-focused Asian countries like the Philippines, Malaysia, and Thailand are also witnessing a similar trend, the data and analytics company said in its 2023 Financial Services Consumer Survey.

In 2023, over 80% of respondents from the three countries had a mobile wallet or had used it to pay in shops, the survey found.

India has the highest adoption rate compared to its peers, with 90.8% of survey respondents saying that they’ve used mobile wallets for payments during a 12-month period.

India’s unified payments interface (UPI), a mobile-based instant payment system, was a main driver for adoption. UPI allows individuals to make instant payments to merchants through their mobile banking app or mobile wallets such as Google Pay, PhonePe, and Paytm.

Indonesia saw its mobile wallet adoption and usage rise to 89.8% in 2023 from just 77% in 2020.

Advertise

Advertise