UPI propels India’s mobile wallet payments to $6.5t by 2028

In February 2024, $221.5b in value was paid across 12.1 billion UPI transactions.

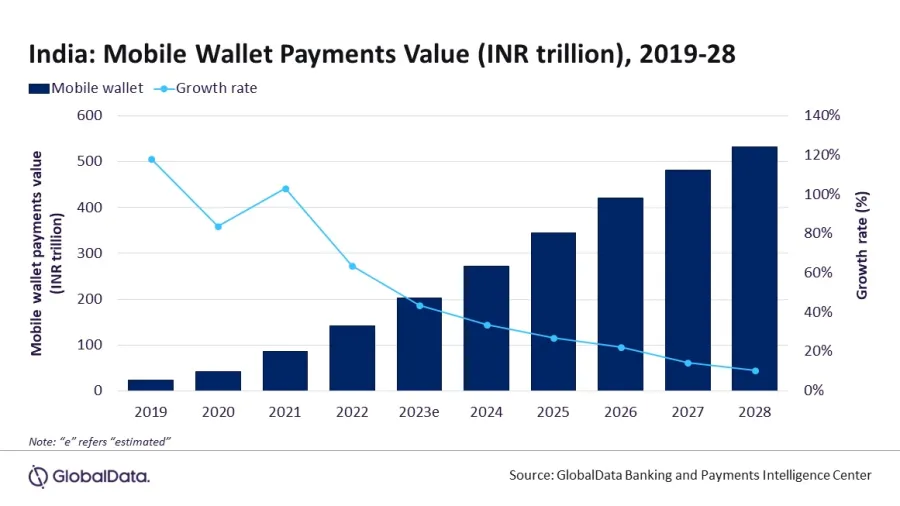

A surge in UPI and QR payments will carry India’s mobile wallet market to an 18.3% growth between 2024 to 2028, or $6.4t in total payment value, forecasts data and analytics company GlobalData.

The value of mobile wallet payments in the country grew by a compound annual growth rate (CAGR) of 72.1% between 2019-2023 to $2.5t (INR202.8t). GlobalData attributed this to the government’s efforts to promote digital payments, most prominently the unified payments interface (UPI).

“The rise in mobile wallet adoption is largely driven by UPI, which facilitates payments in real-time simply by scanning QR codes,” said Shivani Gupta, senior banking and payments analyst at GlobalData.

ALSO READ: India’s stricter regulations to pull down FIs’ loan growth and raise costs

As of October 2023, UPI has a user base of 300 million. In February 2024 alone, $221.5b (INR18.3t) in value was paid across 12.1 billion transactions. In contrast, 7.5 trillion transactions worth $150.1b (INR12.4t) was made over the same period in 2023.

UPI’s rise is thanks to the high smartphone penetration, convenience and proliferation of electronic payments in India, and the incorporation of UPI functionality by several mobile wallets. This, in turn, allows users to conduct QR code transactions directly from their linked bank accounts.

UPI has also been launched in Sri Lanka, Mauritius, and the UAE in February 2024. Similar agreements are in place with other countries like Singapore, and France with more countries expected to follow the suit.

Advertise

Advertise