Cards & Payments

Digital assets considered financial products and subject to law: Aussie regulator

Digital assets considered financial products and subject to law: Aussie regulator

Providers of such products are required to have a financial services licence.

NTT, Jaidee app unveil payment and management platform for Thai SMEs

Super EDC enables SMEs to accept payments and has data management.

Jewel Changi, Mastercard renew partnership amidst rising visitor spend

Cardholder privileges at airport offerings aim to boost spending.

Fiuu launches QR codes for cash-on-delivery payments

Users can receive packages from Pos Malaysia with cashless payments.

Banks see sharp drop in cheque use ahead of 2027 phaseout

More people are using e-payment solutions such as PayNow and FAST.

Five ASEAN countries to establish common standards for non-card instant payments

The accord is part of a 50-year roadmap to develop payments.

HSBC, Juspay unveil acquiring platform for merchants

It offers multiple payment methods through a single provider.

Siam Commercial Bank, Visa, SoftSpace launch tap-to-pay services at two Bangkok markets

Businesses can provide the service either through a smartphone or dedicated EDC machine.

Mainland tourists drive WeChat’s growth during National Day

Cross-border transactions in Weixin Pay increased by 21% year-on-year

Visa appoints Elaine Chang as group general manager in greater China

Chang previously served as president of Amazon China.

Swift developing new retail payment rules to improve cost clarity

Banks from 17 countries will work with Swift to set the retail rules.

Alipay+ enables overseas tap-to-pay service for Kakao Pay users

Kakao Pay users can now make NFC payments at Mastercard merchants worldwide.

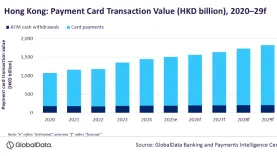

Chart of the Week: Hong Kong card payments to hit $233.5b by 2029

Growing preference for contactless payments will lift the value up.

CBA says RBA interchange reforms risk hurting Aussie firms

The Australian bank agreed that debit and credit surcharging should be eliminated.

APAC instant payments value to reach $170.2b in 2029: GlobalData

China, Japan, South Korea, and India are leading the way.

Ant International to launch Alipay+ in Saudi Arabia

It will connect to mada, Saudi Arabia’s national payment scheme.

PayPay expands reach to 2 million South Korea stores via Alipay+ gateway

Users must complete identity verification on the PayPay app in Japan.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership