Cards & Payments

PayPay expands reach to 2 million South Korea stores via Alipay+ gateway

PayPay expands reach to 2 million South Korea stores via Alipay+ gateway

Users must complete identity verification on the PayPay app in Japan.

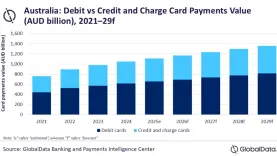

Chart of the Week: Debit card fuel growth of Australia’s card payments market

Australians are choosing to spend within their means instead of accruing debt.

China and Indonesia pilot cross-border QR payments

Selected users from China can now make QR payments in Indonesia using UnionPay and Alipay apps.

Alipay Tap! crosses 200 million users

It lets users pay by tapping their unlocked phone on a payment terminal.

Taiwan’s credit card balance at $3.79b in July

The amount of undue balance of installment rose whilst the delinquency ratio fell.

Ant Int’l and e-wallets launch partnership for enhanced protection

Ant International, alongside e-wallets and payment firms in Asia, have launched the Digital Wallet Guardian Partnership with the goal of strengthening...

Philippines anchors NTT DATA’s Southeast Asia strategy

ADAPTIS will drive omnichannel growth and local innovation.

NTT DATA drives interoperability in digital payments

Growth opportunities seen through cross-border interoperability and SME-focused solutions.

NTT DATA's ADAPTIS targets 43% payments adoption gap

It will fix reliability issues, correct cash misconceptions, and offer value-driven solutions.

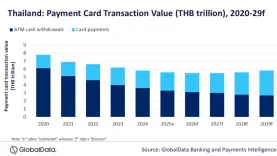

Chart of the Week: Thailand’s POS card payments gain ground as ATM use shrinks

But ATM card usage still dominated.

Airwallex acquires OpenPay, to compete directly with Stripe Billing

Billing capabilities will be rolled out by Q4, Airwallex said.

Ant International’s Antom launches agentic payment solution

Antom can specifically connect AI agents to APMs using Antom EasySafePay.

PH digital bank GoTyme expands free InstaPay transfers to 20 per month

After the 20th transfer, each transaction will cost PHP 9.

Citi and SMRT celebrate 20-year partnership with new card benefits

These include a limited cashback offer for new cardmembers and ringgit savings.

ASIC cancels credit licence of Easy Plan Financial Services

The CSLR had to pay $84,600 on behalf of Easy Plan.

Indonesians can now pay with national standard QR in Japan

They can use QRIS to pay in Japanese merchants scanning the JPQR.

China and New Zealand renew currency swap facility

It is valid for 5 years and has been renewed three times before.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership