Financial digital apps evolve to “3.0” phase as customers’ seek one-stop-shop

Customers increasingly seek a single app that can meet all their financial–and even non-financial–needs.

The future of digital financial services will be one of a one-stop-shop app aggregating all financial services and even non-banking services, deftly embedded in the daily lives of customers, according to WeLab’s Group Chief Strategy Officer Jessica Lam and Bain & Co. Associate Partner Anders Jensen-Waud.

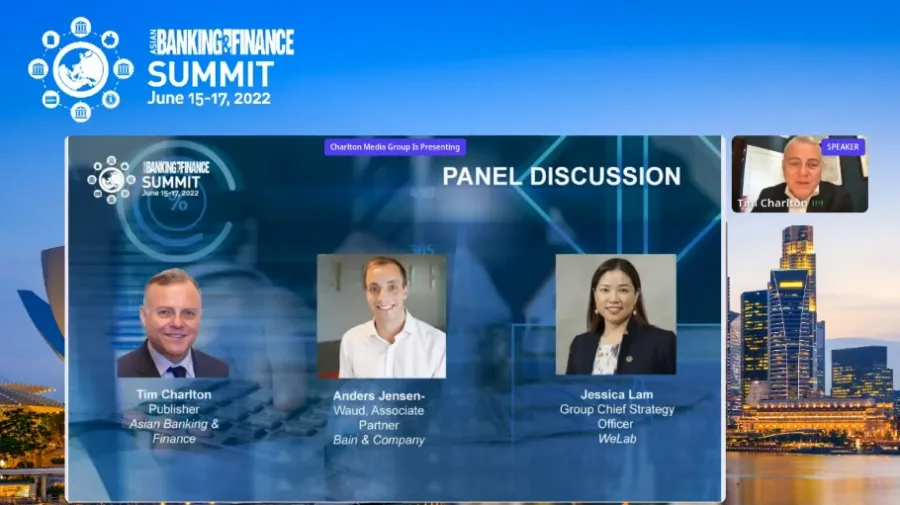

Speaking at a panel discussion during the Asian Banking & Finance Summit 2022, moderated by ABF’s Editor-In-Chief Tim Charlton, WeLab’s Lam described the current trend of customers’ take up of digital financial services being centered on e-wallets as the “1.0” of digital services adoption.

“In Southeast Asia right now,we're still sort of at the 2.0 part, which is the aggregation,” Lam said, noting that e-wallets and banks are starting to bring all financial services together in one platform. “But it will not be long until we move into the 2.5 or 3.0, which is like, ‘give me advice on something intelligent’, not just a data dump of everything.”

The evolution has already begun, with Bain & Co's Jensen-Waud noting that the increasingly digitally-savvy customers are also increasingly expecting that their digital banking journeys will feature the same ease and speed as their e-commerce experience.

“I think that's going to be a big shift over the next couple of years: easier access to credit, easier access to lending and easier access to investment products,” Jensen-Waud told attendees of the panel.

Right now, this evolution is in the phase where customers–especially those in Southeast Asia–are pushing the limits of what their e-wallets can do, WeLab’s Lam said.

“Is there a limit on the wallet size, or how much we can spend and transact there? Can we start to link this to longer-term things in our life, financial products that are not just a one off insurance, when I go for a trip when I travel? Can it be life insurance, can be longer term protection, etcetera. And so I think what you're seeing is a deeper embedding into the lifecycle of an individual customer,” Lam said, adding that there will be increasing sophistication in the type of services demanded and delivered.

Lam believes that digital banks are the “middle segment” that can deliver this one-stop shop app.

“The digital bank, in my view, is the best of both worlds. Because we have that mindset and the agility that Andrew has talked about before; don't have the burden of the legacy. Because a lot of what traditional banks face, sometimes it's not just a mindset, but it's just the way the organization is set up, or how the infrastructure is set up. So it's not that they don't want to change, it's just very hard to do that shift overnight when you've got a lot of people in your organization,” Lam noted.

Digital banks’ lack of legacy may allow them to more easily build their infrastructure from the ground up, but incumbent banks likely have the customer data. But whether they can properly wield this data is another story.

“In general, there's been a lot of hype around data, right? And there's been a lot of, “all we need to invest in big data. We just need to hire data scientists…” [But] that's not the answer. It has to be really fit for purpose,” Bain & Co’s Jensen-Waid said.

Jensen-Waud added that for banks, the financial data they hold may not even be enough; it may do them good to look into partnership in order to combine the financial data the banks’ hold with the non-financial, customer behavior data that other apps may possess.

“If you combine those, and you have a very, very big opportunity to really win over and do a lot more with the customer relationship,” Jensen-Waud said.

Ultimately, however, what is holding back incumbent banks in particular is that they have the tendency to approach services and app-creation in a far too technical viewpoint.

“I think what's missing, and this is probably more for the incumbent banks, is the ability to think and anchor this around customers' needs. Often, banks think about their products; they think about the cars, the cash. They think about your online banking or remittance, right, that that's very sort of this product centric mindset,” Jensen-Waud said.

Jensen-Waud said that, in order for banks to thrive during a time of digital evolution, they must start to think about which services meet customers’ needs–both financial and even non-banking related–rather than just look at the breadth of products they offer.

Watch the video below to watch the panel discussion:

Advertise

Advertise