Hong Kong Monetary Authority

The Hong Kong Monetary Authority is the government authority in Hong Kong responsible for maintaining monetary and banking stability. Its main functions and responsibilities are governed by the Exchange Fund Ordinance and the Banking Ordinance and it reports to the Financial Secretary.

See below for the Latest Hong Kong Monetary Authority News, Analysis, Profit Results, Share Price Information, and Commentary.

Hong Kong central bank names deputy CEO for exchange fund investment office

Hong Kong central bank names deputy CEO for exchange fund investment office

Goh previously worked in Goldman Sachs and J.P. Morgan.

HKMA warns public of online scams targeting local banks

The Bank of East Asia reported fake websites and internet banking login screens.

Hong Kong’s credit card transaction value decline in Q2

This is despite the volume of transactions rising during the quarter.

Hong Kong eases info-sharing in banks’ anti-fraud push

The changes let banks share more information without fear of liability.

Singapore and Hong Kong enhance banking supervision cooperation

It enhances supervision of cross-border operations of banks under their purview.

Hong Kong's banks encouraged to explore tokenised deposits and assets

Authorities are expected to work together to regularise the issuance of tokenised bonds.

Hong Kong opens consultation on phase 2 of green finance taxonomy

It added 13 new economic activities and expanded sector coverage.

ABN AMRO Clearing Bank granted restricted banking licence in Hong Kong

There are now 16 restricted licence banks in the city.

Hong Kong’s mortgage loan applications, approvals rose in July

Mortgage loans for primary market and secondary market transactions both increased.

HSBC fined HK$4.2m for disclosure breaches in research reports

It is estimated to have affected disclosures in over 4,200 reports.

HKMA study identifies AI and data analytics as key banking skills

Another key finding is the importance of a collaborative approach across the industry.

Hong Kong lenders consider making bad bank to offload $25b in soured loans

Hang Seng Bank and BoCom reportedly mulled setting up a special vehicle.

Hong Kong says Chong Sing Heritage Trust an unauthorized bank

The bank does not have authorization to carry a banking business in Hong Kong.

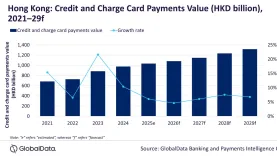

Chart of the Week: HK credit and charge card market to reach $132.4b

Banks are rolling out new services, such as a mobile virtual card and a dual-currency card.

Hong Kong credit card values up 8.4% to $34.91b in Q1

The number of debit card transactions fell although the value rose.

Hong Kong, China launch Payment Connect for faster cross-border payments

Supported services include instant remittance services, amongst others.

HKMA, HKUST Business School ink MoU for applied cybersecurity research

They will explore supervisory tech and regulatory tech.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership