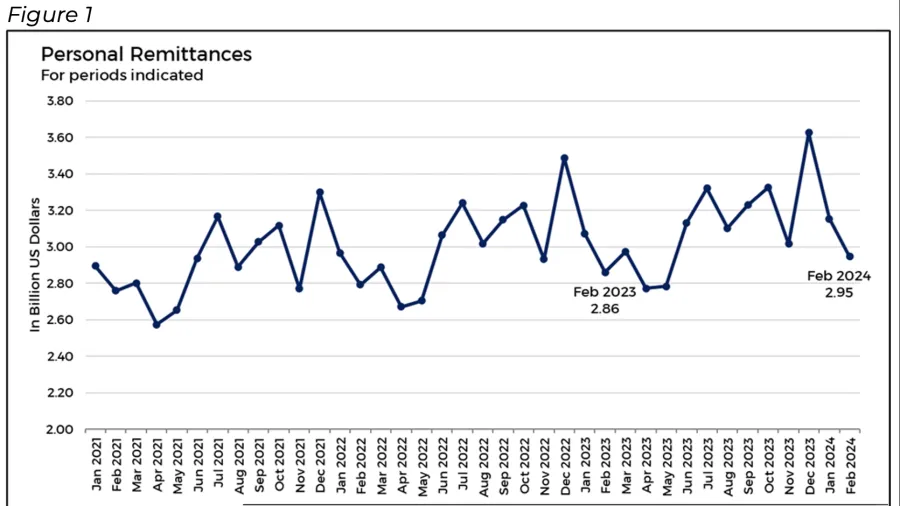

Overseas Filipinos’ remittances up 3% to $2.95b in Feb

A total of $2.65b in remittances coursed through banks, the central bank said.

Personal remittances from Overseas Filipinos (OFs) grew by 3% to $2.95b in February, according to central bank data.

Cumulative personal remittances also rose by 2.8% to $6.1b in January-February 2024, from $5.93b in the same period in 2023.

Cash remittances that flowed through banks equaled $2.65b in February, a 3% rise from the same month in 2023. This was due to growth in receipts from both land and sea-based workers, according to data from the Bangko Sentral ng Pilipinas.

ALSO READ: APAC payments gateway market to rise 30% as cashless economy expands

Cash remittances from the United States, Saudia Arabia, Singapore, and the United Arab Emirates (UAE) contributed to the higher remittances in January-February 2024.

In terms of country source, the U.S. had the highest share of overall remittances during the period, followed by Singapore, Saudi Arabia, and Japan.

Advertise

Advertise