Chart of the Week: Japanese regional banks are carrying heavy loan burdens

They're not making enough profit off their massive loan balances.

The steady growth of loan balances held by Japanese regional banks in the past three decades is proving to be an increasingly heavy burden to carry for the embattled lenders.

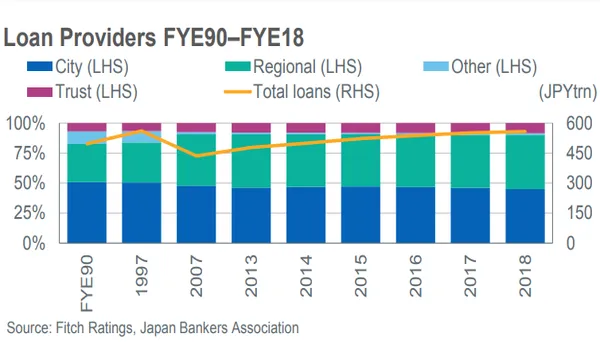

The market share of regional banks in the loan market grew from 32% in the financial year ending March 1990 to an estimated 45% in 2018, according to Fitch Ratings, effectively edging out the share of city banks from 51% to 45%.

In fact, loans account for the lion’s share of regional bank assets at 64% with securities only representing 22%.

Also read: Struggling Japanese regional banks go over the edge to cut losses

However, this puts the smaller lenders at a weaker position to squeeze profits out of their massive loan balances given the prevailing low-interest rate-environment. Regional banks generate 85% of their profit from net interest revenue.

“[Regional banks] interest margin squeezed from prevailing low interest rates,” analyst Kaori Nishizawa said in a report.

Also read: Japanese regional banks form fintech venture in bid for survival

Unlike their megabank counterparts, Japan’s regional banks are also unable to expand to overseas markets to soften the blow of the lending crunch as they must abide by their mission to support the country’s economic development.

Against this dismal environment, a number of regional banks have turned to aggressive practices to boost profitabilty at the expense of corporate governance standards. This follows the case of Suruga Bank who published a report highlighting an aggressive corporate culture that witnessed employees resorting to fraudulent activity to meet unrealistic growth targets and the resignation of Higashi-Nippon Bank chairman in August over improper lending practices.

Advertise

Advertise