Asia-Pacific IT Priorities: One Year After the Pandemic

By Eiichiro YanagawaA Survey of Financial Services Firms.

Celent conducts regular surveys of trends in the financial services industry. In this survey, Celent examines IT priorities in the new normal, one year after the pandemic.

The survey consisted of 10 questions, asked in both August 2021 and July 2020, seeking input about post-pandemic business goals, IT budgets, and priorities for applying IT to the new normal. The survey questions are almost the same, but with slight modifications to reflect the new situation.

The majority of survey participants were senior managers, including C-level executives, followed by middle managers and practitioners. The geographic distribution was about 70% in Japan and 30% in the major APAC financial markets (Singapore and Hong Kong).

The method was to obtain quantitative responses in an online survey, followed by a telephone interview to obtain qualitative views from the respondents.

Many open-ended responses of the survey participants were recorded in their statement quotes (anonymously). The biggest change in 2021 was the progress in the application of IT to the new normal that reflects the widespread use of vaccines and infectious disease control. There was less concern about stagnation in innovation and more positive talk about exploring growth strategies in the new normal with IT as an enabler.

There was a clear shift in gears from "survival" (supporting customers and employees under a pandemic) in 2020 to "prosperity" (understanding new customer behaviors, searching for new approaches, and implementing new normal business practices) in 2021. Major financial institutions in Japan and APAC have begun to use IT as an enabler and to use IT to change their business organizations. The reverse of Conway's Law (“IT architecture will change your organization.”) has begun.

Asia-Pacific IT Priorities One Year After the Pandemic: Key Research Findings

How have your business goals changed?

- The impact on process optimization (93%) remains the strongest.

- Innovation (64%) and competition from other companies (64%) are more of a concern than product/service diversification (58%) and cost reduction (57%).

- Concerns about growing and maintaining a business (42%) have receded significantly.

- The effects of vaccination and the recovery of economic activity have clearly shifted business goals from defense to offense.

How have IT budgets changed?

- The majority of respondents (57%) indicated that they have already done so about reviewing their IT budgets, reversing the results for "unlikely" and "under consideration" (43%).

- Of the respondents who reviewed their IT budgets, 36% increased their budgets (compared to 14% in the previous survey) and 7% reduced their budgets (compared to 14% in the previous survey), significant shifts.

- Shifting gears (new IT investment for the new normal: 36%) outperformed maintaining the status quo (sticking to the IT roadmap: 29%). The application of IT to the new normal, accompanied by increased budgets, is now in full swing.

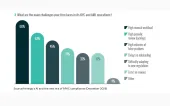

What are the top priorities in the new normal?

- After reviewing IT infrastructure for the new normal (19%), increasing efficiency (15%) and improving customer experience (15%) emerged as priorities.

- The top priority has clearly shifted from ensuring IT connectivity and continuity (14%) to finding medium- to long-term IT investment opportunities (79%).

- The key to responding to the new normal is becoming clearer. Understanding customer behavior, gaining resilience and dealing with the constant new IT environment (Cloud and Security).

- The application portfolio is moving away from a front-heavy focus, with growth in middle and back office data analytics and trade/business execution.

This time last year, only the most advanced financial institutions had begun to update their IT roadmaps to adapt to the new normal. There is a clear shift in gears from “Survive" (customer and employee support) to “Thrive" (new business growth in the new normal). Many financial institutions have begun to use IT as an enabler to transform their business organizations with IT.

Advertise

Advertise