Chart of the Week: Australia’s credit and charge market to rise in 2025

Benefits and flexible repayment options is driving frequency of use.

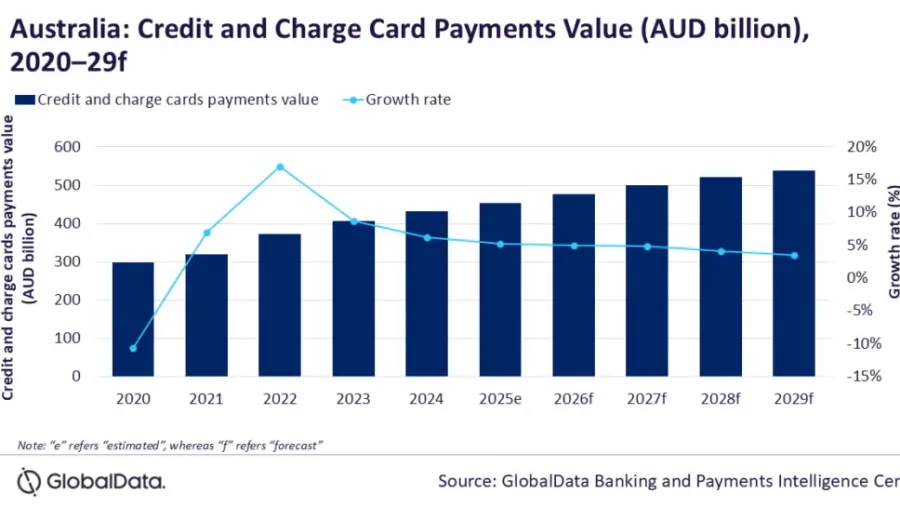

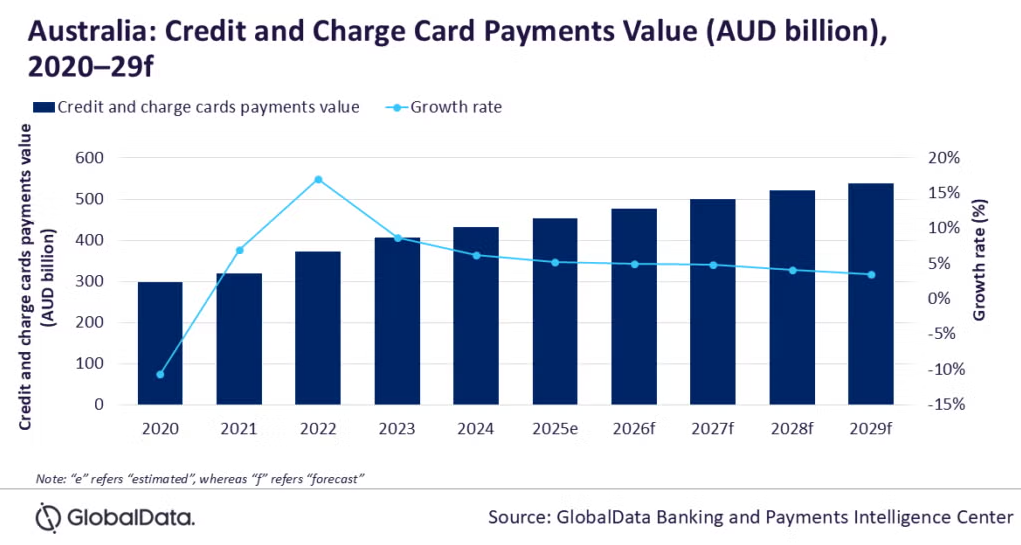

Australia’s credit and charge card payments market is expected to reach $299.7b (A$453.9b) in 2025, according to estimates by GlobalData.

The value of payments in the market is forecast to grow at a compound annual growth rate (CAGR) of 4.4% between 2025 and 2029 to reach A$539.1b ($356 billion) in 2029.

The market’s payment value in Australia grew 6.3% in 2024, the data and analytics company said, driven by a rise in consumer spending.

“Consumers frequently utilize these cards to capitalize on benefits, including cashback offers and rewards programs,” said Kartik Challa, senior banking and payments analyst at GlobalData.

Frequency of payments per card is at 225.5 times in 2024. It is anticipated to rise to 239.5 per card by 2029.

Banks offering flexible repayment options, cashbacks, rewards points, discounts, and installment facilities will help drive the rise in frequency of use, GlobalData said.

Australia’s well-developed payment structure will also drive use. The country has 39,031 POS terminals per million inhabitants in 2024. This is higher than in China (33,641), Hong Kong (27,184), and India (6,964).

“Australia’s credit and charge card market is poised for sustained growth over the next five years, driven by the economic recovery, growing consumer spending, and growth in e-commerce payments,” Challa said.

Challenges would be the ongoing global trade tariff dispute among major countries, and geopolitical uncertainties, Challa added.

Advertise

Advertise