CIMB still on track to hit 2025 loan growth target

Clients have reportedly turned cautious.

CIMB Group is expected to hit the lower end of its loan growth target of 5% to 7% for 2025 even as business sentiment turns cautious.

The Malaysian bank’s management reportedly allied to business sentiment remaining cautious following the US tariffs, reports UOB Kay Hian, based on CIMB’s channel check with clients.

Clients have reportedly adopted a ‘wait-and-see’ posture, which reinforces a more guarded lending stance. This is reflected in Q1 2025, where corporate lending softened, reflecting lumpy repayments and a more selective credit environment, said UOBKH analyst Keith Wee Teck Keong.

“We correspondingly trim our 2025 loan growth assumption to 5% from 6%,” Wee said in a report on 6 May 2025.

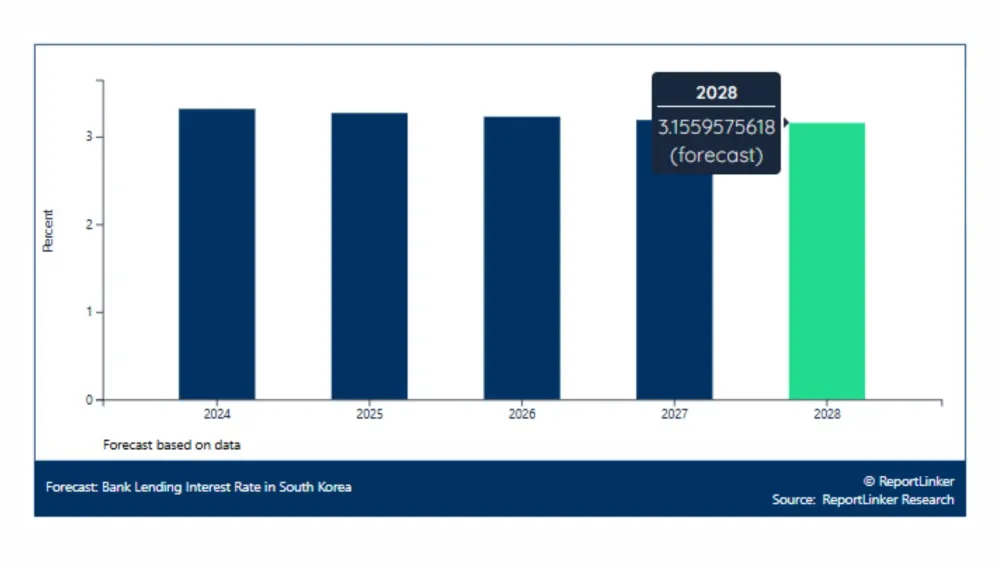

Impact of the tariffs is expected to unfold progressively, beginning with slower loans growth, potential policy interest rate cuts that could pressure CIMB’s net interest margin (NIM), and likely lead to asset quality deterioration.

On the flipside, CIMB reportedly views its direct exposure as manageable. Trade-related loans made up less than 5% of its group loans, and US export exposure reportedly comprised just 3% to 5% of group loans.

Advertise

Advertise