APAC neobanking hits $261b in 2025 as mobile use rises

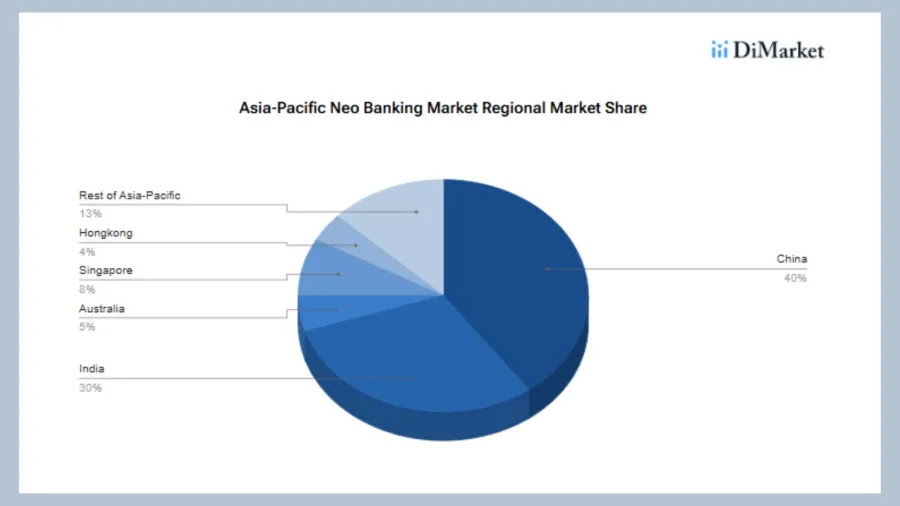

China and India account for 70% of regional market share.

The Asia-Pacific (APAC) neo-banking is estimated to surge by 47% to of $261.4b in 2025, influenced by rising mobile banking use, fintech development and a growing digitally focused younger population, according to DiMarket.

By market size, China is estimated to have the largest share with 40%. This was followed by India (30%), the rest of APAC (13%), Singapore (8%), Australia (5%), and Hong Kong (4%).

These trends are particularly strong in fast-growing economies such as China and India, where consumers are shifting towards digital-first banking solutions.

Mobile banking, payments, fund transfers and lending services are among the strongest performing segments of the market.

Both corporate and individual accounts are contributing to growth as more users adopt digital banking platforms.

China and India are expected to remain the main drivers of regional expansion, whilst markets such as Singapore, Australia and Hong Kong are also forecast to record steady growth.

Increased demand for personalised financial services is supporting the sector’s expansion, with many providers using artificial intelligence and machine learning to improve customer experience and service delivery.

Despite the strong outlook, the sector faces risks related to cybersecurity, data privacy and changing regulations.

Industry observers say continued technological development and the rise of embedded finance solutions are expected to shape the future direction of the Asia-Pacific neo-banking market.

Advertise

Advertise