APAC

Digital wallets, agentic AI to speed up payments

Digital wallets, agentic AI to speed up payments

The focus is on agentic systems that can act on behalf of users.

1 day ago

APAC private banking to grow 9.43% CAGR

The market is forecast to expand from $44.3b in 2025 to $76.05b by 2031.

2 days ago

How will agentic AI change online payments?

It’s unclear who’s liable if it over‑orders or pays the wrong merchant.

2 days ago

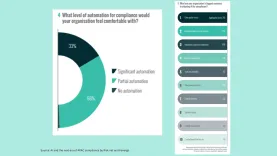

Why Asian banks struggle to embed AI in compliance

Institutions cite fragmented infrastructure, manual workflows and skills gaps as barriers.

3 days ago

Banks to pursue smaller and more strategic M&As in 2026: McKinsey

Smaller banks are prone to getting acquired as they struggle with funding and tech costs.

6 days ago

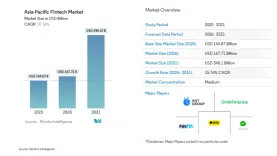

Asia-Pacific fintech to hit $348.1b by 2031

The market will be driven by mobile-first usage and open API payment rails.

6 days ago

Financial services M&A deal value rise 40% on improved bank profitability

Postal Savings Bank of China’s $18.1b deal with China Mobile is the year’s top deal.

How can Asia-Pacific fintechs survive this year’s funding slowdown?

Hong Kong could emerge as a bright spot.

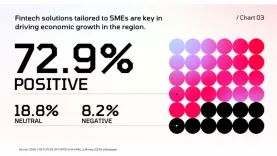

Fintech expands SME credit as 72.9% see growth impact

SMEs make up over 90% of businesses across Asia yet face constrained traditional financing.

How digital payments are forcing QSRs to rebuild checkout and staffing

They're redesigning counters and drive-thrus for QR codes and e-wallets.

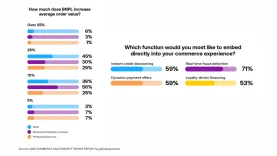

BNPL drives embedded finance as 51% report 25% revenue lift

40% said average order value rose 25% or more in the same survey

APAC fintech funding slumps 52% as VC investment craters

Total fintech funding reached $19.4b across 1,675 deals in 2022 before sliding.

SMBC appoints Salim Zaman as global head of FX

Zaman will continue to serve as co-head of global markets and treasury in APAC.

How will mergers and crypto regulation reshape APAC fintech investment in H1?

Chinese fintechs will embrace "dual-market routes" to grow overseas.

Bank J. Safra Sarasin names Dong Chen as Asia CIO

Chen worked at J.P. Morgan Private Bank and Pictet Wealth Management.

Asia’s banks hold the mandate to innovate. Now they must earn it.

Banking is no longer measured against other financial institutions, but against digital experiences.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Customers now expect visibility alongside instant credit experiences.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership