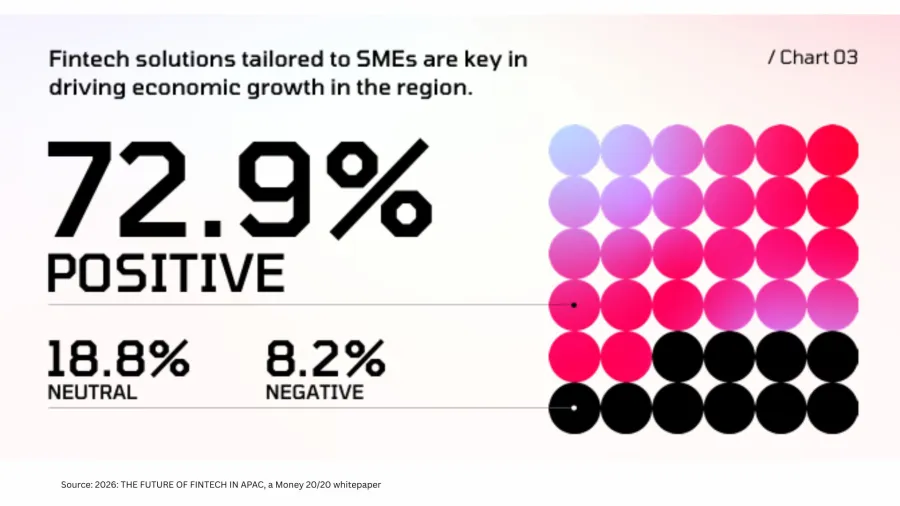

Fintech expands SME credit as 72.9% see growth impact

SMEs make up over 90% of businesses across Asia yet face constrained traditional financing.

Financial technology (fintech) stakeholders, including banks, fintech companies, consultants, and industry experts, believe that small and medium enterprises (SMEs) are key in driving economic growth this year.

In an industry survey of 130 respondents, 72.9% believe that fintech solutions for SMEs have a positive effect on economic growth. Meanwhile, 18.8% feel neutral and 8.2% believe there is a negative impact.

SMEs account for more than 90% of businesses across Asia but have long faced limited access to traditional finance, constraining their growth despite their role as key economic drivers in the region.

Interviews and survey responses across the region showed broad agreement that SMEs remain underserved by conventional banking, and that fintech solutions designed for smaller firms are critical to supporting regional economic growth.

Fintech lenders and digital banks are expanding SME-focused offerings.

Malaysia’s Boost Bank is introducing alternative credit scoring models, whilst the Philippines’ Maya Bank is developing supply chain financing products.

Cambodia’s Hattha Bank has waived merchant discount rates for payments collected through KHQR codes to lower transaction costs for merchants.

Beyond credit, fintech platforms are integrating SMEs into broader digital ecosystems and super apps that provide market access and operational tools.

For example, Cambodia’s Wing Bank allows small merchants to track daily sales through KHQR payments and use transaction data to qualify for digital loans of up to $50,000.

Credit decisions can be made within minutes through the app, enabling firms to restock or expand without traditional collateral.

Industry participants say the alignment between fintech innovation and SME demand presents a significant opportunity across Asia.

By narrowing long-standing financing gaps and reducing payment frictions, digital financial services are expected to support further growth in the region’s small business sector.

Advertise

Advertise