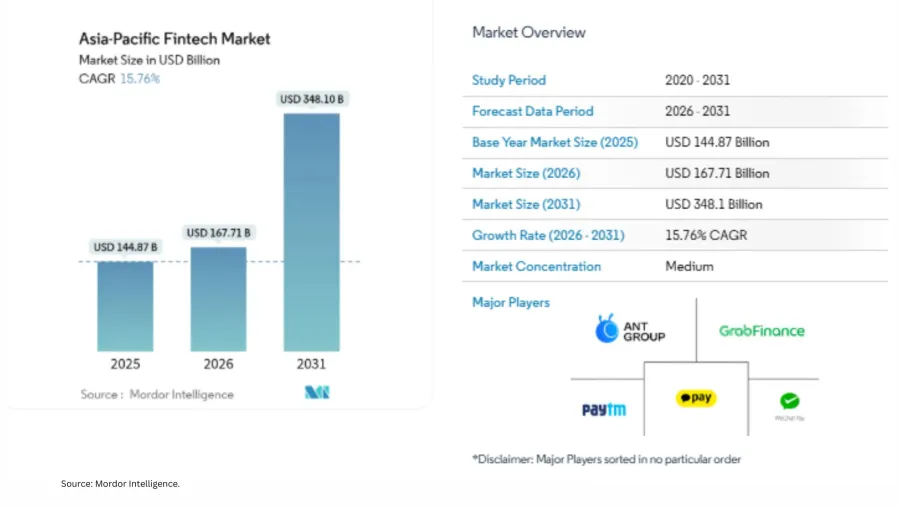

Asia-Pacific fintech to hit $348.1b by 2031

The market will be driven by mobile-first usage and open API payment rails.

Asia-Pacific’s financial technology (fintech) market is forecasted to garner $348.1b by 2031, pencilling a compound annual growth rate of 15.8% from 2026.

The fintech sector is likely to bag $167.74b this year, up 15.8% from the estimated $144.9b value for 2025, according to Mordor Intelligence.

The market’s growth will be driven by widespread mobile-first adoption, government-backed real-time payment infrastructure, and a more flexible licensing environment for digital-native banks.

These structural shifts are lowering onboarding times and transaction costs whilst attracting investment from both venture capital and established financial institutions.

Super-apps are also expanding their reach by combining payments, lending, investment, and insurance in a single platform, increasing user engagement and lifetime value.

Cross-border payments are gaining pace as regional instant-payment systems become interoperable.

The Bank for International Settlements’ Project Nexus links India’s UPI, Singapore’s PayNow, and Thailand’s PromptPay into a shared settlement network, reducing remittance costs and enabling new revenue streams for business-to-business platforms.

National instant-payment schemes are also scaling domestically. India’s UPI processed 131b transactions worth $1.8t in 2024, reflecting a shift in consumer behaviour away from cash.

Policy changes around digital identity and electronic know-your-customer processes are expanding access to financial services.

Indonesia, the Philippines, and Bangladesh together add more than 400 million newly verifiable adults, prompting regional neobanks to accelerate market entry.

Instant-payment networks such as UPI, PayNow, and PromptPay remove settlement delays and lower interchange fees, whilst enabling cross-border use cases such as Singaporean tourists paying Thai merchants directly at market exchange rates without card surcharges.

Real-time payment rails are becoming embedded infrastructure that fintech firms can access through open APIs to launch peer-to-peer remittance, payroll, and merchant-settlement products with lower development costs.

Merchants are increasingly adopting QR-based payments because of lower device costs and faster access to funds, eroding card volumes for small-value transactions below $25.

Continued government support for point-of-sale upgrades suggests instant push payments will become the dominant retail payment method in Asia-Pacific by the middle of the decade.

Advertise

Advertise