Malaysia

E-wallet use jumps to 65% amongst Malaysia’s 25- to 34-year-olds

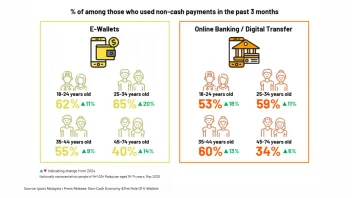

E-wallet use jumps to 65% amongst Malaysia’s 25- to 34-year-olds

Older users logged a 14% rise year on year but still trail younger groups on this method.

11 hours ago

Maybank pilots tokenised ringgit for cross-border payments

The bank aims to pioneer a range of tokenised assets, from Islamic finance to wealth products.

1 day ago

Hong Leong Bank rebrands wealth segment as HLB Priority and revamps centres

Modernisation of priority centres is scheduled to be completed around March 2026.

Malaysia payments flip non-cash as e-wallet usage jumps 14%

Online bank transfers also gained whilst debit and credit cards ranked last amongst users.

Malaysian bank loan growth to stabilise at 4.5% to 5.5% in 2026

The 2025 slowdown to 4.8% seen as normalisation after 2024’s 5.5% expansion.

Malaysia credit growth eases to 5.3% as business loans cool

The banking system’s liquidity coverage ratio rose to 154.8% during the month.

Precision Growth, AI Operations: Asian Banking & Finance and Insurance Asia Summit Heads to Kuala Lumpur

The event will feature insights from industry figures at AmMetLife, CIMB Trustee Group, Simon-Kucher, and Generali Insurance Malaysia Berhad.

Maybank targets 13%–14% ROE by 2030 under ROAR30 strategy

It aims for a NIM of over 2.05% and a cost-to-income ratio of not more than 47%.

Deutsche Bank Malaysia appoints first female chair, new non-executive director

The appointees bring expertise in finance, audit, risk, governance, policy.

Malaysia’s central bank says FATF outcome supports financial system confidence

The upgrade reflects stronger compliance and effectiveness in tackling money laundering.

Malaysian banks see lending growth soften ahead of year end

Deposit growth improved whilst loan growth may be around 5% for 2025.

CIMB’s net profit up 2.34% to $502.6m in Q3

Non-interest income rose by over 20% during the quarter.

Aeon Bank and Zurich Malaysia extend partnership to offer Takaful plans

Customers can avail of a plan for as low as MYR5 or MYR18.

Maybank’s net profit up 3.7% to $1.9b in 9M 2025

Net fund based income and higher NOII helped lift up profits.

Affin Bank expected to see 30.6% quarterly drop in Q4 net profit: report

The upturn in loan loss provisioning will lead to the decline, said CGS International.

Malaysian banks’ sector earnings on track for growth in 2025

Loan growth was stable in September, although household loan growth was slightly slower.

Fiuu launches QR codes for cash-on-delivery payments

Users can receive packages from Pos Malaysia with cashless payments.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership