Goldman topped APAC M&A in 2025 as Morgan Stanley fell: LSEG

China International Capital Co. and Somerley got the most gains in 2025.

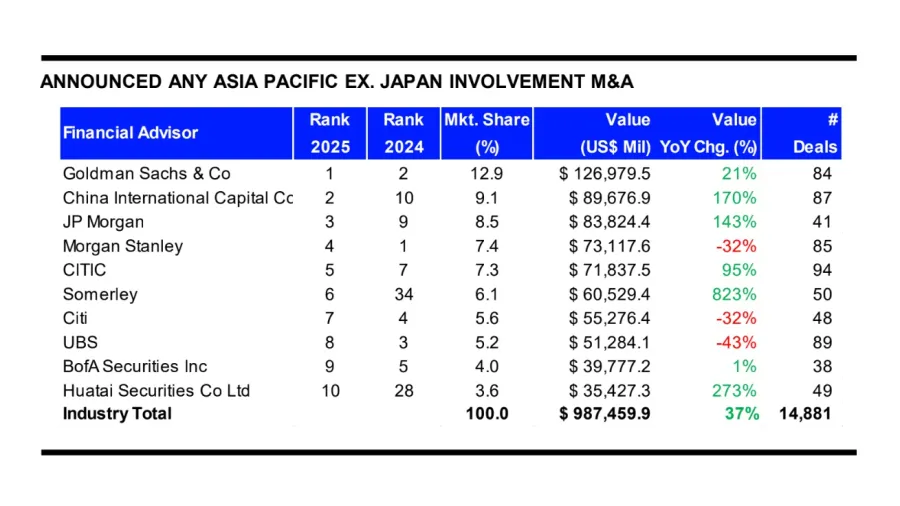

Goldman Sachs & Co. was involved in the most mergers & acquisitions (M&A) deal activity in the Asia Pacific region in 2025, according to data from LSEG Data & Analytics.

Goldman Sachs clinched over $126.97m across 84 deals. This deal value is 21% year-on-year (YoY) higher compared to 2024.

The bank, together with Singapore’s DBS, completed their first interbank over-the-counter (OTC) cryptocurrency options trade in late 2025.

China International Capital Co. and J.P. Morgan followed,amassing $89.68m and $83.82m in deal values, respectively. These are more than double the deal values they got in 2024.

China International Capital Co. notably rose from the 10th spot in 2024 to 2nd overall in 2025.

Morgan Stanley saw a 32% YoY decline in value, reporting $73.11m for 2025, and falling from the top spot in 2024 to fourth overall in 2025.

Somerley, a Hong Kong-based investment bank, recorded the biggest gains amongst the top 10 firms listed in LSEG’s league table. It rose from 34th place in 2024 to 6th place in 2025, with deal value growing 823% YoY to $60.53m.

Hiring for investment bankers in Hong Kong remained slow in mid-2025, although analysts noted demand for top-performing deal makers and occasional aggressive hiring sprees.

Advertise

Advertise