Lower credit costs to drive Singapore banks' earnings rebound in 2021

Sufficient provisions, steady capital positions should reduce risks in the near term.

Lower impairment charges will likely drive Singapore banks’ earnings’ recovery in 2021, amidst tight margins from low rates and a modest pickup of loan growth, reports Fitch Ratings.

In a report, the ratings agency notes that the provisions made by the big three banks—OCBC, DBS, and UOB—in the past year have provided them with adequate buffers against credit impairment surprises.

“We believe provisions made in 2020 have provided the banks with sufficient buffers against credit impairment surprises. These, together with steady capital and liquidity positions, should reduce risks to the banks' credit profiles in the near term,” said Fitch analysts Priscilla Tjitra and Tania Gold.

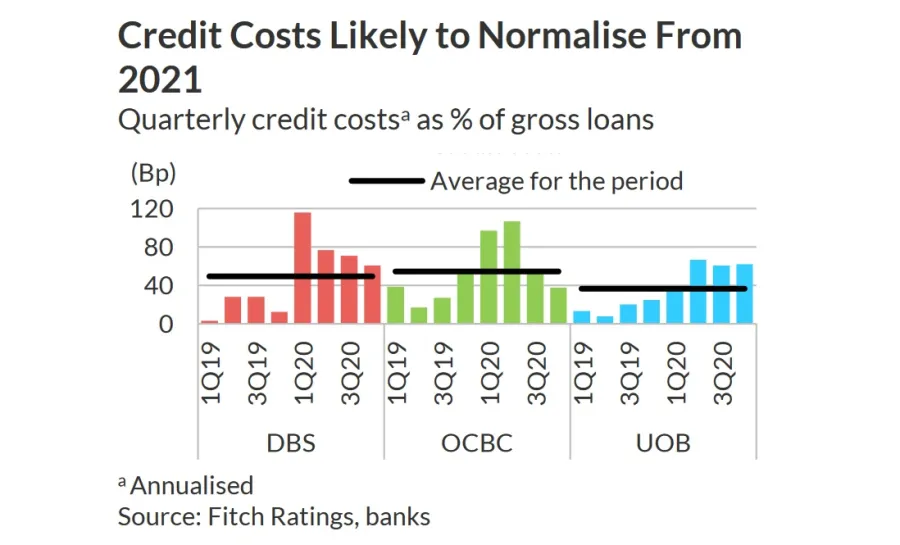

Singapore banks' impaired-loan ratios remained stable at 1.5%-1.6% at end-2020, whilst loans under relief fell to just 1%-2% of gross loans. Meanwhile, the banks' credit provisions rose to an average of 73 basis points (bp) of loans from 23bp in 2019, which enhanced their loan-loss coverage ratios including regulatory reserves to an average of 109%, up from 87% in 2019.

Credit costs are expected to begin returning to a “normalized” range in 2021, Tjitra and Gold noted.

The banks' capitalisation and liquidity positions also remained solid as at end-2020.

Meanwhile, modest balance sheet growth and improved capital accretion from earnings growth should limit the risks from credit migration.

“The banks' balance sheets are adequately positioned to take advantage of growth opportunities when the economy turns around, though pressure on capitalisation may return if growth outpaces profitability,” the analysts added.

Advertise

Advertise