Thai banks brace for weaker 2026 earnings as rate cuts hit margins

Loan growth may pick-up but likely to stay in single digits, says Fitch.

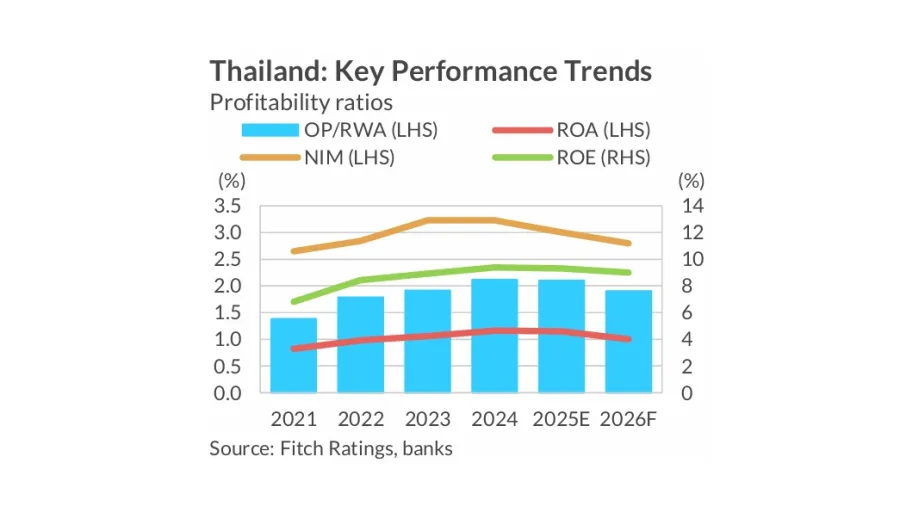

Thai banks' weakening earnings trend is likely to continue in 2026, warned Fitch Ratings.

Net interest margins (NIM) will be hurt by declining interest rates. The Bank of Thailand (BOT) lowered its policy rate to 1.5% as of November 2025, from 2.5% in October 2024. Fitch expects two more rate cuts over the next year.

Loan growth may pick up from a very low base given pent-up demand but is likely to stay in single digits.

Thai banks' loans dipped 1% year-on-year in Q3 2025, BOT data showed. Loans to consumers and small and medium enterprises (SMEs) continued to decline.

One bright area are business loans, which is expected to see growth in Q4 2025, based on a senior loan officer survey by the BOT. Consumer loan demand will likely be boosted by auto loans, it said.

The sector is expected to prioritise asset quality and clean loan portfolio in the near future. In a UOB Kay Hian report, analyst Thanawat Thangchadakorn observed that some banks have continued to beef up special provisions to cushion against future uncertainties.

Advertise

Advertise