Bad loans of Philippine alternative lenders to decrease in 2022: study

The rate of their bad loans has hovered around 10% to 10.5%.

The rate of alternative lenders’ bad loans in the Philippines is expected to decrease marginally in 2022 as employment continues to recover.

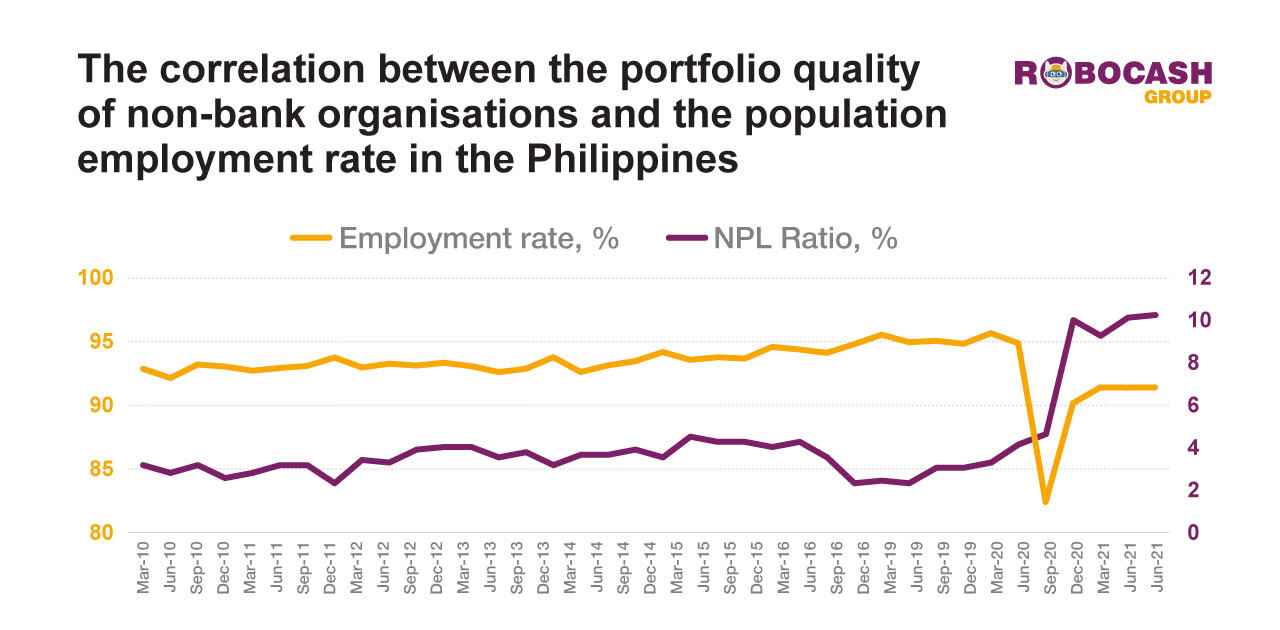

An analysis by the non-bank lender, Robocash Group, posits that, with the employment rate expected to go up by at least 1 percentage point, the share of alternative lenders’ non-performing loans will decrease by 0.33% in 2022.

The portfolio quality of alternative lenders has considerably decreased due to the COVID pandemic, according to Robocash’s data. The rate of non-performing loans has hovered between 10% to 10.5% since the third quarter of 2020. Prior to the pandemic, the rate hovered between 4% to 5%.

The rate is expected to get better in 2022, with Robocash noting a quarterly survey by the Bangko Sentral ng Pilipinas that found that Filipinos expect the employment rate to grow, as well as the population’s wellbeing and the general state of the economy in the country to improve.

Advertise

Advertise