Chart of the Week: Will the HSR cancellation dampen Malaysian banks' loan growth?

The downturn may even offset the strong performance of household loans.

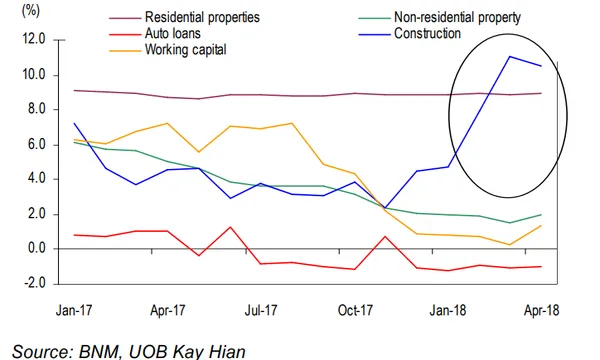

The cancellation of mega infrastructure projects including the High Speed Rail project with Singapore could dampen the main growth engine of Malaysian bank lending which is construction-related loans, according to UOB Kay Hian.

Construction-related loans nearly doubled from 4.5% in 2017 to 9.5% YoY as of end-May but could face significant slowdown in the near term, said UOB analyst Keith Wee Teck Keong.

The sharp downturn could even offset the positive impact from strongger consumer spending during the three-month tax holiday period, Keong added. This comes as the move by the newly elected Pakatan Harapan government to scrap the goods and services tax (GST) is expected to boost consumer sentiment and jumpstart household loans which represent more than half (57%) of total loans in the banking system..

"This has prompted us to retain our 5.0% full-year 2018 loans growth assumption with a slight downside bias," Keong added.

However, positive effects of the GST cut is expected to spill over to other loan segments, BMI added, easing concerns of a banking slowdown.

“On the back of this, we expect credit card loans growth to further improve on a strong start to 2018. Credit card loans grew 3.8% y-o-y in April and the average growth rate in the first four months of 2018 was 3.7%, picking up from an average of 2.2% in 2017,” BMI Research added.

Advertise

Advertise