Personal loans, NBFCs anchor surge in Indian outstanding bank credit

Both segments comprised 73% of incremental credit in April.

Personal loans and non-bank financial companies (NBFCs) led the growth in Indian outstanding bank credit year-over-year in April 2020, accounting for 73% of incremental credit during the period, a CARE Ratings report showed.

Housing loans remain the single largest segment of lending in outstanding credit to the retail/personal loan portfolio, comprising 60% share of the incremental credit to the segment. Credit card outstanding credit registered a 10.3% decline, followed by consumer durables (down 4.2%) and vehicle loans (down 1.7%).

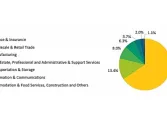

The share of the industry sector in total outstanding credit remains the highest at 31.7%, followed by the services sector at 28.3%, retail at 27.4%, and agriculture at 12.7%. However, retail, services and agriculture have all dragged incremental outstanding credit down, with credit growth in the industry sector falling 0.7%.

Large industries comprised 84.1% in total outstanding credit to industries, inching up 0.4% MoM in April. Petroleum, coal products and nuclear fuel recorded a growth rate of 7.7%, surging 48.8% YoY. Credit outstanding to construction saw a downturn of 5.1%, whilst credit to infrastructure crept up 0.1%.

NBFCs, although posting a modest 0.6% increase, still formed the largest part in total credit outstanding for the services sector at 36.1% followed by trade (21.2%) and commercial real estate (8.9%). Tourism, hotels and restaurants recorded a decline of 0.3% and trade slowed to 1.3%.

Around 31% of the total incremental outstanding credit in April was towards the priority sector. Within the priority sector, agriculture accounted for the highest share in outstanding credit followed by MSMEs and weaker sections. Within micro and small enterprises, services and manufacturing witnessed a growth of 0.1%, with a share of 67.4% and 32.6%, respectively.

Photo courtesy of Wikimedia Commons.

Advertise

Advertise