Lending & Credit

Two reasons why rising NPLs will continue to haunt Thai banks in 2H17

Two reasons why rising NPLs will continue to haunt Thai banks in 2H17

The weak SME economy is partly to blame.

Traditional lending in China sees a 'renaissance' as shadow banking slows down

Net corporate bond issuance has been increasing.

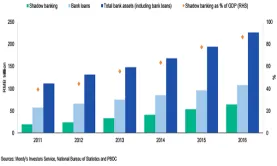

Chart of the Week: Shadow banking in China more than doubled since 2012

Shadow banking assets reached US$9.5t in 2016, but growth is finally slowing down.

Is China making progress in reining in shadow bank growth?

The enhanced regulation is finally showing some results.

Chinese banks in Australia boost corporate lending by 23% as the big four pull back

They also increased their direct property lending by 50%.

Thai banks to be hit by higher rate of SME loan delinquencies

The ratio of non-performing SME loans hit 4.5% at end-March 2017.

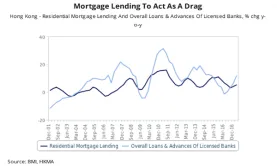

Chart of the Week: Hong Kong banks' mortgage lending to slow

Rising interest rates are to blame.

Singapore banks' system DBU loan growth to hit 2% in 2017

That is if housing loans grow by up to 6%.

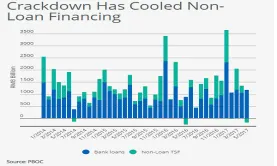

How does China's move to curb shadow banking affect banks?

The measures benefit the banks but also bring adjustment risks.

Thai banks' loan growth to hit 5% in 2017

Loan demand will pick up in the second half of 2017.

Chart of the Week: Check out Hong Kong banks' growing exposure to the property sector

Direct lending by banks to developers increased 23.6% in March.

Malaysian banks' absolute gross impaired loans up 7.1% in May

The banks' asset quality is still deteriorating.

Chinese banks urged to tackle loss-making 'zombie firms' as part of reform

Beijing is promoting supply-side structural reform.

China's shadow banking crackdown finally cools credit growth

Bank lending growth has held up, while non-loan TSF declined in May.

This worst case scenario could hurt Thai banks' profits by up to 29%

Krung Thai Bank will be most impacted.

Chinese banks endure record high borrowing costs

Moody's says profitability will be affected.

Indian banks ordered to go to court to resolve $31b bad loans

The banks are urged to use insolvency laws.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership