Lending & Credit

Hong Kong banks' capital to be hit by tighter property regulations

Hong Kong banks' capital to be hit by tighter property regulations

But impact is expected to be manageable.

What you need to know about 'ghost collaterals' haunting Chinese banks

These fraudulent collaterals endanger the health of China's financial system.

Everything you need to know about Indian banks' $191b 'zombie' debt

It's threatening the country's economic expansion.

Banks may not be lending enough if bad debts don't rise during tough times

Singapore's central bank chief says they're probably not taking on sufficient risks.

Thai banks' lending growth to recover in the second half of 2017

Some banks announced lower loan rates for some customers in May.

Hong Kong banks raise mortgage rates

As the HKMA raised risk-weighted floor to 25% for new residential loans.

Chinese banks' average annual loan growth to hit 7% till 2020

Client loans could reach US$18.7t in 2017.

3 reasons why Japanese megabanks' shift towards subordinated loans for corporates is a good move

One of the reasons is that it supports risk-adjusted profitability.

Thai banks' asset growth hit new cycle low in March

No thanks to the sharp drop in interbank and derivative assets.

China banks' NPL ratio flat at 1.74% in Q1

Asset quality has largely stabilised.

Large state-owned banks in China conservative in recognising NPLs

But NPL formation has moderated since 2H16.

Indian regulators intensify efforts to solve banks' bad loan problems

Asset resolution will be a dominant theme in the sector over the next few years.

China regulator launches emergency risk assessments for banks' lending practices

It will include the banks' issuances of negotiable certificate of deposits.

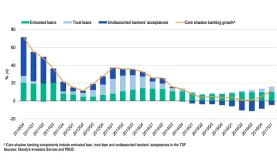

Chart of the Week: Core shadow banking activities in China rebound in Q1

That is after slowing to a near stall in 2016.

Risks rise as Chinese lenders ditch struggling corporates for retail borrowers

The switch is fuelling an unusual jump in home loans.

How does the tight systemic liquidity affect China's shadow banking sector?

Stricter regulations aim to constrain the growth of leverage in the country.

Chinese regulators to increase scrutiny of the shadow banking sector

These new measures are likely to be negative for corporate bonds.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership