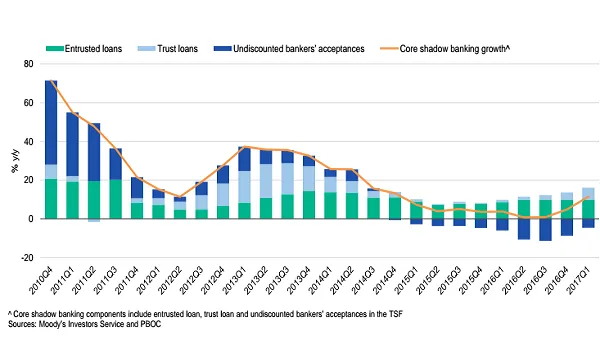

Chart of the Week: Core shadow banking activities in China rebound in Q1

That is after slowing to a near stall in 2016.

According to Moody's, the current rebound is mainly driven by stronger growth of trust loans and entrusted loans. The contribution from undiscounted bankers’ acceptances remains negative but has narrowed constantly in the past two quarters.

"The up-tick in core shadow banking may reflect tighter financing conditions elsewhere, especially as access to traditional banking credit and domestic bond market to marginal corporate borrowers becomes more restricted," added Moody's.

Advertise

Advertise