China

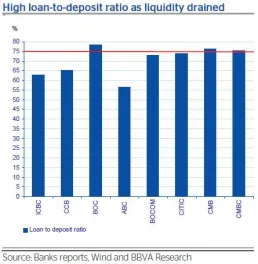

Chinese banks still burdened by tight liquidity

Chinese banks still burdened by tight liquidity

Cuts in required reserve ratios are not enough to fully offset the tighter liquidity conditions, says BBVA.

CCB begins massive expansion of branch network

China Construction Bank Corporation plans to open 2,000 more branches until 2016.

Chinese banks cut mortgage rates

Mortgage interest rates are falling in Chinese first-tier cities with the gradual recovery of the property market.

GRGBanking's net income up by 6.61% to US$80.46m

But after deducting the non-operating gains and losses the profit only increased by 5.39% to US$77.6 million.

Chinese banks intensify lending

Chinese banks lent a record US$160 billion in March in a bid to boost China’s faltering economy.

China hammers big banks again, warns of severe punishment

China is putting increasing pressure on state-owned banks to reform.

China lauded by IMF and WB for improved bank regulations

Chinese banks have made "significant improvements in risk measurement and risk management", according to experts of the IMF and World Bank.

Will bad debts continue to hurt Chinese banks?

Reports say that China's non-performing loans surged to US$68b at the end of 2011 - is this the start of a looming credit crisis in China? Find out what analysts from Fitch and Standard & Poor's have to say.

China loosens grip on foreign-funded banks

China takes another step towards opening its highly regulated banking system to the outside world.

Which way is the wind blowing for Asian CFOs?

Let’s face it: those developed economies, that once were the ones spinning the globe including Japan, are currently fire-fighting their daily affairs of debt crisis, unemployment and so on. Emerging markets like South America, China, India and Indonesia are now taking the lead with unprecedented growth surge.

Is outsourcing still relevant for banks?

It all started in the 1980s when Outsourcing first come into sight in the IT industry. This was the time when companies acknowledged the benefits of having IT service partners in development of complex systems, and improved the way that a business process or service is managed. It paved the way for advent of a new genre of business approach, termed “Outsourcing” and in today’s world it has become an entity, important at that, enhancing every business system.

The long march of the Renminbi

Over the last few months, investors have frequently expressed to me their concerns about the change of leadership in Beijing likely to take place in the autumn of this year and what that might mean for the pace of reform in China’s economy and markets.

ICBC records record high net profit in 2011 amid growing bad loans

ICBC's net profit for January to December period gained 26% to CNY208.27 billion or US$33 billion from CNY165.16 billion.

China Construction Bank posts 25% net profit growth

China Construction Bank registered a 25.48% growth in its $26.89 billion net profit in 2011.

Top Chinese banks post embarrassingly high profits

Seven of China’s leading banks lean on interest income to book record profits.

Minsheng Bank to raise US$1.4 billion

China Minsheng Banking Corporation, Ltd needs some US$1.4 billion to meet tougher government regulations.

Gulf States a gold mine for China’s top bank

The Industrial and Commercial Bank of China's assets and lending double, thanks to the booming demand for trade financing.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership