China

Russian banks to forge closer ties with Chinese partners

Russian banks to forge closer ties with Chinese partners

Russian banks expect to sign agreements with Chinese partners on financing several projects in Russia during President Vladimir Putin's visit to China next week.

HSBC China to be among the first for direct RMB-Yen trading

HSBC China will be among first market makers for the direct trading of the renminbi and yen after it was approved by China's central bank.

JP Morgan Chase invests heavily in China

JPMorgan Chase & Co has raised its capital of its Chinese division to over US$1 billion to exploit broader opportunities arising from a further liberalization of China’s banking sector.

Direct yen-yuan trading to begin this week

China has taken a key step towards making the yuan or renminbi a truly global currency.

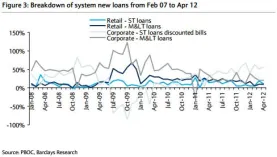

Loan mix in China may shift to more mid- and long-term loans

So far loan growth year-todate was mainly driven by short-term corporate loans and discounted bills, says Barclays Research.

Chinese banks finally open up to private capital

China’s decelerating economy has compelled China’s banks to accept private investments to generate funds for lending to small and medium enterprises.

Chinese businesses shun bank loans as economy worsens

China’s banking sector is lending less and less because of the spreading economic slowdown.

Chinese banks sell more forex than it purchased

Chinese banks bought US$110.2 billion on behalf of clients in April and sold US$113.9 billion U.S. dollars, resulting in a net sale of 3.7 billion U.S. dollars.

Chinese banks encouraged to seek private investment

China's banking regulator told its financial institutions to focus more on attracting private investment.

Australian and Chinese banks suffer from bank-bashing governments

Why are the banks in two of the world’s better-performing economies under government scrutiny?

What could be the most effective means to ease liquidity in China?

BBVA suggests PBoC should cut rates asymmetrically to help stimulate the demand for loans but warns that bank profitability may have to suffer.

Chinese banks see drop in bad loans

China's banks reported a reduction in bad loans fall and the maintenance of capital strength in the first three months of 2012.

Chinese banks’ foreign expansion “irresistible”

A Chinese professor at Yale University believes the acquisition of control over Bank of East Asia by the Industrial and Commercial Bank of China and its financial partners will be the first of many by Chinese banks.

Chinese commercial banks' NPL ratio below 1%

The non-performing loan ratio in the first quarter for China's commercial banks went down by one percent from last year at 0.9 percent.

China needs more banking reforms

The government again goes to bat for small businessmen.

Demand for loans remains weak for Chinese banks

Lack of new loans continue to haunt China's four biggest banks in the first two weeks of May.

ANZ to triple investments in China

Australia & New Zealand Banking Group Ltd. (ANZ) will triple the size of its banking network in China.

Advertise

Advertise

Commentary

Why APAC banks must rethink their approach to the cost reduction challenge

Thailand backs major conglomerates for digital banks but risks stifling innovation