China

Chinese banks' profitability takes a hit from narrowing NIMs

Chinese banks' profitability takes a hit from narrowing NIMs

But PwC said large commercial banks were 'spared the worst of pain'.

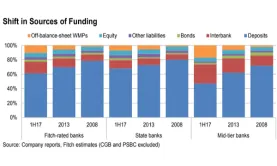

Chart of the Week: Check out how China banks' funding profiles have evolved

Off-balance-sheet WMPs filled the gap between assets and deposits.

Why state support is still key to keeping China banks' stability

The PBOC's balance-sheet claims on depository institutions hit US$1.4t as of July.

Chinese banks: An endless cat and mouse game benefitting large players

When one door closes, another one opens up. As deleveraging moves up in the scale of objectives of the Chinese leadership, banks now face more restrictions from regulators. In any event, this is not the first time they find themselves in the regulatory whirlpool. From the usage of repo agreements to wealth management products (WMPs), and most recently negotiable certificate of deposits (NCDs), banks have been very creative in playing the cat and mouse game in front of evolving regulations.

Here's why Chinese banks' net interest margins are likely to expand

Loans are gradually repriced whilst deposit rates will likely remain unchanged.

Chinese banks' earnings to stabilise over the coming quarters

The banks' net profit rose 7.9% in Q2.

Two themes that were evident in most Chinese banks' Q2 results

The banks registered NIM expansion of 4-8bp.

Shadow banking risks focused on China's regional lenders

Rust belt banks use shadow banking to conceal their bad loan status.

China's largest banks raise billions to fund Belt and Road investments

China Construction Bank eyes raising at least $15b.

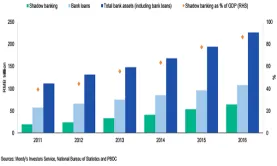

Here's how China's shadow banking sector evolved over the years

The regulators and financial institutions seemingly have played a “Whack-A-Mole” game, says BBVA.

Outstanding balance of bank-issued wealth management products in China up 9% to US$4.3t

It represents almost a fifth of bank deposits.

Traditional lending in China sees a 'renaissance' as shadow banking slows down

Net corporate bond issuance has been increasing.

Big banks fail to keep up with Chinese fintech giants in mobile payments

The value of third-party payments in China grew more than 74 times from 2010 to 2016.

Chart of the Week: Shadow banking in China more than doubled since 2012

Shadow banking assets reached US$9.5t in 2016, but growth is finally slowing down.

Is China making progress in reining in shadow bank growth?

The enhanced regulation is finally showing some results.

China extends deadline for banks to submit risk assessments

Eight sets of rules were launched by the CBRC since March.

Outlook for China's banking system improves for the first time since 2015

Moody's has revised its outlook for to stable from negative.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership