Indonesia

Asset quality in Indonesia and Malaysia most likely to deteriorate

Asset quality in Indonesia and Malaysia most likely to deteriorate

But other ASEAN banks are in a better position.

A nice surprise: CIMB Niaga's NIM expanded to 5.4% in 3Q15

CASA also increased at a robust rate of 15.7%.

Double trouble: Indonesian banks at risk of high external debt and the presence of weak banks

But risks are lower than implied, says Moody's.

Debt threat: Indonesian banks' profits pressured by rising bad debts and slowing economy

Bank Negara Indonesia's gross NPL ratio rose to 2.8% for the first nine months of 2015.

Bank Negara Indonesia's net profit reaches nearly US$ 444m in the first nine months of 2015

Thanks to a spike in corporate lending.

2 things local regulators must do to improve financial inclusion in Indonesia

Allowing partnerships with multiple service providers is one.

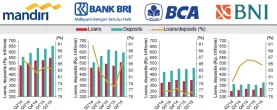

These charts show how profits of the 4 largest Indonesian banks plummeted in the second quarter

Combined profit fell 14.62% to 14.685 trillion rupiah.

Islamic banking in Indonesia to grow as demand for Sharia-compliant bonds rises

Year-to-date sales of retail sukuk have been oversubscribed.

Big Indonesian banks to weather FX, commodity risks: Fitch

Credit profiles are "sufficiently resilient".

Indonesia troubled by ailing loans from small businesses

Business-loan proportion dropped to 26.2%.

ASEAN banks well capitalized to meet Basel III capital ratios

As well as liquidity ratios.

Indonesia's banks have been outpacing regional peers in profitability

It's been the case since 2013.

Shaky Indonesian loans put UOB under threat

Asset quality will deteriorate.

Indonesia's Islamic finance roadmap to spur growth of domestic sukuk market

Even smaller Islamic banks will benefit.

Can Indonesia's large state-owned banks weather challenges in 2015?

Profitability likely to stand strong.

Indonesia grooms an Islamic megabank from its 3 major state-owned lenders

Islamic banking has grown exponentially in Indonesia.

Indonesian banks' growth relies on rate cuts and infrastructure

Its banks will benefit from infrastructure spending.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership