Japan

Mizuho’s profits up 1.2% to $1.93b in Q1 FY2025

Mizuho’s profits up 1.2% to $1.93b in Q1 FY2025

MFG has revised its full-year earnings outlook upward.

SMBC appoints Joy Kwek to lead capital markets & solutions in APAC

Kwek joins from Morgan Stanley.

Mizuho to acquire majority of Upsider’s shares for $309.8m

Upsider provides corporate credit card and invoice payment services.

MUFG and JICA establish sustainable finance framework

It will be applied by MUFG and four partner banks in Southeast Asia.

Shinkin Central Bank’s strong liquidity backed by sticky member deposits

It has very low credit risk in its investment portfolio and loan book, says Moody's.

Demand for loans in Japan “about the same” in April-June

Firms of all sizes saw little change in demand during the period.

American Express opens Centurion Lounge at Tokyo’s Haneda Airport

Cardholders will have access to a specialty drinks and sweets bar.

Japanese banks seek higher interest incomes on rising rates, tamed deposit costs

Credit costs and nonperforming loans remain stable for the banking sector.

Japan’s megabanks brace for lower earnings growth on US uncertainties

They only expect a 7.9% net income growth, lower than the 25.3% previously.

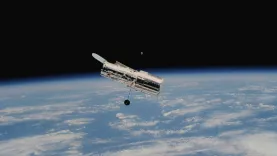

SMBC invests in space transport and satellite integration startup

The megabank seeks to help grow Japan’s space industry.

Citi nabs Nomura senior MD as co-head of investment banking in Japan

Citi managing director Taiji Nagasaka will lead alongside new hire Akira Kiyota.

SMBC becomes strategic partner of TOMODACHI Initiative leadership program

The next program will involve 20 university undergraduate students in Japan.

Japan’s SMBC invests in biotechnology fund

ANV aims to create global biotech companies of Japanese origin.

Natixis CIB to establish banking branch in Japan

Its Tokyo branch had operated under a money lending license for three years.

Shoko Chukin Bank face high problem loans but profitability improving

The higher problem loans ratio may be due to its focus on the SME segment.

MUFG invests in May Mobility for autonomous vehicle deployment

MUFG will help the company scale its fleet to thousands of vehicles, it said.

MUFG partners with Kodansha, CREDEUS team up to fund film productions

They will fund live-action film series adaptations of Kodansha-published works.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership