Korea

South Korean banks' loan delinquency ratios rise in April

South Korean banks' loan delinquency ratios rise in April

Delinquency of loans extended to households edged up 0.02 ppt.

South Korea's fiscal stimulus to carry lasting headwinds

It will reduce loan defaulting, but also loosens credit standards.

COVID-19 accelerates digital payments adoption in South Korea

The country’s credit card issuers are seeing a rise in credit card use for online purchases.

Korean banks face irreversible headwinds as disruptions persist

Four regional banks are particularly at risk of asset-quality deterioration.

South Korea and China are Asia's cashless leaders

More than half of Korea’s 1,600 bank branches no longer accept cash deposits or withdrawals.

South Korea NPL ratios still strong despite multi-year lows

Asset quality remains stable.

South Korean banks stay ahead despite digital surge: report

Fintech companies will stay focused on money transfers and other simple transaction services.

Why Korean banks will remain steady despite subdued Q3 profits

They stand to benefit from expansions and from the low-rate policy environment.

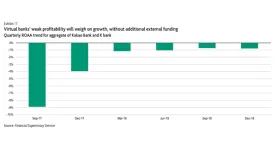

How kakaobank successfully cracked the profitability code two years after rocket launch

In the first half of the year ended June 31, kakaobank hauled net income of KRW10b ($8.58m), booking net profit for the first time following a protracted loss-making period.

Cards to reign supreme in South Korea as cash loses appeal

By 2020, cards will emerge as the dominant payment instrument.

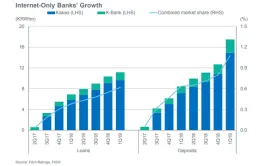

Mobile banking transactions in Korea hit $5b in H1 2019

Internet-only banks drove robust adoption.

Internet banking transactions in Korea hit record high in 2018

The number of transactions broke the 100-million mark for the first time.

Chart of the Week: Korea's internet-only banks still sparring for market share

The two players only account for 0.6% of the loan market in Q1.

Finda helps on-the-go Koreans in securing loans

It offers evaluation of personal loans without having to submit hard copy of documents.

Korean banks forge consortium to develop blockchain-based mobile identification

It will allow individuals to store key personal information needed for online transactions.

Korea resumes applications for third internet-only bank

Rejected applicants Toss Bank and Kiwoom Securities are welcome to re-apply.

Chart of the Week: Korean virtual banks still struggling to crack the profitability code

ROAA is still relatively low at -0.9% in December 2018.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership