Korea

Korean banks to maintain London operations despite Brexit: report

Korean banks to maintain London operations despite Brexit: report

Reports noted that banks considered Frankfurt for their new locations amidst Brexit fears.

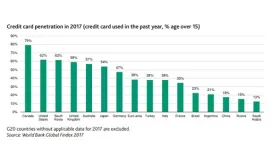

Korea's open banking system threatens dominance of credit card issuers

Credit card issuers may lose their tax incentive to fintechs.

Woori Bank ties up with Chinese banks for remittance service

Money sent in KRW will be received in RMB. Woori Bank has tied up with China banks including ICBC, Bank of China and the Bank of Communications as well as financial services company UnionPay to launch a money-transfer service which will let customers to easily send money to Chinese bank account holders, reports RetailNews Asia. Through the new service, a user will be charged $8.9 (KRW10,000) for transactions less than $1,777 (KRW2m). Meanwhile, for remittances over $1,777 (KRW2m), the charge will be a flat rate of $18 (KRW20,000). Money sent in KRW will be received in RMB by the Chinese bank account holder who will receive the money. Jointly developed by Woori Bank, Woori Card, and Union Pay, the service includes a notification of the transfer result via text.

Korea sets up open interbank payment network to boost fintech

Available to nonbank players, the scheme aims to lower required usage costs.

South Korea braces for third internet-only bank

Shinhan Financial Group and mobile app maker Viva Republica are forming a consortium.

South Korea's property curbs cool January household loans

The growth was its lowest since November 2017.

South Korean banks' forex turnover hits decade-high at $55.51b in 2018

Strong capital inflow boosted yearly figures.

South Korea has no plans to issue a digital currency soon

The central bank said there is no immediate need to introduce such currency.

Korean major banks to cut working hours

The move comes after the country implemented a 40-hour work week.

Korea slaps $600,000 fine on 4 global banks over forex rigging

JP Morgan Chase faced the highest penalty of $223,000.

Korean banks' 2019 profit to slow to $8.66b as home loans take hit

Residential property prices have been losing momentum.

Tech firms set to raise stake in Korea's internet-only banks

IT firms will soon be allowed to hold as much as 34% stake.

Korean banks' bad loan ratio falls below 1% in Q3 for first time in a decade

Shipping corporates are making good headway in the crackdown.

Korean banks shun traditional business as population ages

The share of non-bank assets hit 20.3% from 14.5% in 2013.

South Korean banks take a breather from rapid expansion plans

Lenders will focus on domestic exposure to SMEs and households.

Korean banks zero in on booming expat market

Lenders are growing their foreign currency desks.

Korea's shrinking bad loan record at risk as SOHO loans turn sour

Such loans accounted for a fifth (22%) of total bank lending as of end-June.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership