China's shadow banking assets shrinks to $8.42t in Q3

These assets now only account for 62% of the nominal GDP from 68% in 2018.

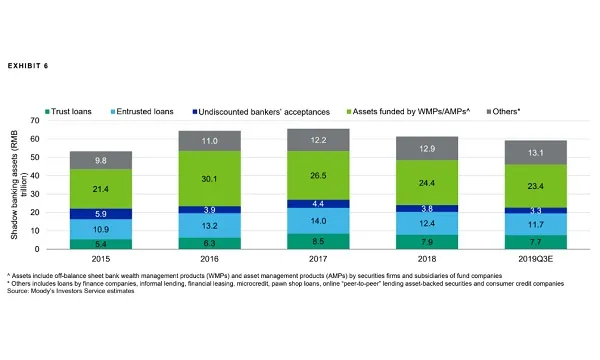

Shadow banking assets in China contracted by $30b (RMB2.1t) between Q1 and Q3 to end at $8.42t (RMB59.2t) in September, a report by Moody’s Investors Service revealed.

These assets now only account for 62% of the nominal GDP as of 30 September from 68% by the end of 2018. Shadow banking assets peaked at 87% in 2016.

However, the decline in the third quarter was only $56.88b (RMB400b), far below the decline of $240b (RMB1.7t) in the first half of the year, noted Moody’s.

Also read: China to let up on shadow banking crackdown in 2019

Assets funded by WMPs and AMPs continued to shrink between the first three quarters of 2019, falling by $140b (RMB1t) so far in 2019 r as they remain the main focus of the regulatory crackdown that began in 2017.

Asset management products originating from banks and non-bank financial companies (NBFCs) as well as entrusted loans drove the contraction, with asset management businesses originating from these institutions continuing to record declines.

Also read: China's shadow banking sector to shrink to half of GDP in 2019

Core shadow banking assets, including entrusted loans, trust loans and undiscounted bankers’ acceptances, also recorded declines. Entrusted loans and undiscounted bankers’ acceptances declined by $85.32b (RMB600b) and $71.1b (RMB500b), respectively.

Advertise

Advertise