Markets

Japan's banking regulator surveys lenders on impact of COVID restrictions

Japan's banking regulator surveys lenders on impact of COVID restrictions

The regulator is reportedly seeking to prevent a huge rise in bankruptices of businesses.

Bangladesh issues sovereign sukuk worth $463.24m

A total of 39 financial institutions participated in the auction.

Shopee parent Sea acquires Indonesia's Bank BKE

The tech startup has raised $3b in stock offering for its business expansion plans.

Pandemic-driven rapid digital growth benefits APAC incumbent banks

Despite the rise in digital banking demand, neobanks’ performances faltered compared to incumbent peers.

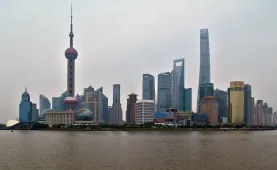

Debates arise on security law's effects on Hong Kong finance sector

Is there really a capital exodus from Hong Kong to Singapore?

What banks are getting wrong in their restructuring plans

Lenders are relying too much on past risk data and numbers instead of long-term growth prospects.

Singapore regulator floats guidelines to boost FIs' ethics, accountability

Senior managers responsible for core functions should be identified.

More profit woes for Chinese banks as regulators plan NPL hike

$160.9m of targeted full-year NPL resolution were completed in H1.

Weekly Global News Wrap: Banks eye layoffs as pandemic costs loom; Credit Suisse applies for Spanish investment bank licence

And JPMorgan exits Brazilian private banking business.

China's megabanks ramp up employment despite falling profits

The Agricultural Bank of China has already hired 4,500 people.

South Korean banks' FX deposits hit record $87.4b in July

Dollar deposits gained $2.76b during the month.

Asset quality, earnings pressure loom over Australia's big banks

There is underlying economic uncertainty due to rising infections and stricter restrictions.

Thai banking system still strong despite lower profits: central bank

Capital funds and provisions were raised to guard against the slump.

Jefferies, Regis Partners team up for Philippine cash equities business

Jefferies will distribute equity research on local-based companies to its client base globally.

Indian prime minister keen to ramp up stake sale of four banks: report

The government is pushing for privatization to help raise funds for its budget.

Weekly Global News Wrap: Goldman Sachs cuts Q2 earnings for 1MDB settlement; Barclays probed for spying claims

And Revolut says losses more than tripled in 2019.

Return of private placements boost Chinese regional banks' capital

They allow for tailored government participation in bank recapitalisation.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership