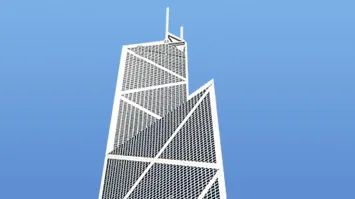

Bank of China HK's net profit up 12.3% in Q1

Net income reached HK$15.23b.

For the first three months of the year, Bank of China (Hong Kong) Holdings showed a 12.3% net profit growth year-on-year (YoY).

This was equivalent to HK$15.23b (US$1.94b), versus the previous year’s HK$13.57b (US$1.73b).

Net interest income could have risen 39.3% YoY to HK$11.87b (US$1.51b) if the cost of foreign currency swap contracts were incorporated.

Net interest margin (NIM) was at 1.50%, driven by rising market interest rates in the first quarter compared to the same period last year.

Due to diminished investor confidence, the decline in trade and the lack of business recovery, net fee and commission income decreased 17.8% YoY to HK$2.51b (US$320m).

“As a result, commission income from loans, securities brokerage, funds distribution and management, insurance, bills and payment services decreased. Meanwhile, commission income from credit card business and currency exchange increased, mainly because the border reopening boosted consumer confidence and travel.” the group said in a filing.

ALSO READ: Bank of China HK warns of fake website

Meanwhile, operating expenses went up 6.9% YoY. This makes the company’s cost-to-income ratio at 25.41% in the first quarter.

Because of the increase in advances of clients' securities investments and other debt instruments, total assets for the first quarter reached HK$3.76t (US$480b), up 2.5% from the last month of 2022. Total deposits climbed 5.5% to HK$2.51t (US$320b).

(HK$1 = US$0.13)

Advertise

Advertise