Investment to Singapore fintechs in Q2 down 55% from Q1

Blockchain & Crypto firms snagged the lion's share of deals, but enthusiasm may wane amidst new regulations.

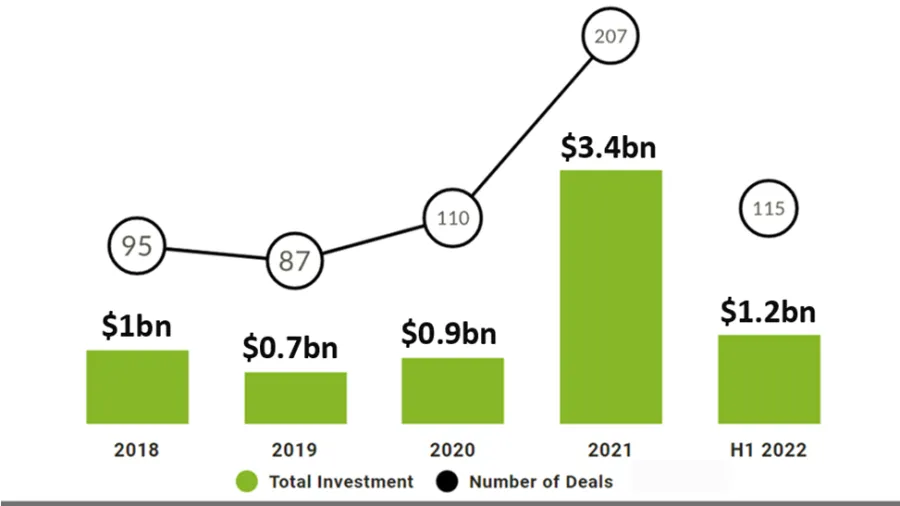

The funding raised and overall deal activity of financial technology companies in Singapore declined in Q2 compared to the previous quarter, according to data gathered by FinTech Global.

FinTech companies in Singapore raised US$378m in funding during the second quarter, 55% lower than in Q1. Deal activity also fell 23% compared to the previous quarter, but overall deal activity in 2022 should still surpass 2021 levels by 11%, according to FinTech Global.

Singapore followed global trends of deal sizes reducing significantly in Q2 from Q1.

READ MORE: Japan fintech investments fall to five-year low in Q1

“Global deal sizes in Q2 2022 have been reduced significantly from Q1 2022 as public FinTech market valuations drop across the board and investor reassess the value of their portfolios,” FinTech Global said in a report.

Per sector, blockchain & crypto accounted for 48% of the total deals in the country during the period, with 24 deals. However, this dominance may trail off in the third quarter with local regulators intensifying its crackdown on blockchain and crypto firms.

In April 2022, new regulations were issued that subjected digital asset providers to local Anti-Money Launder (AML) and Combating the FInancing of Terrorism (CFT) requirements.

Singapore has also reportedly denied over 100 applications from firms seeking to launch crypto operations as of 11 April.

In the long run, however, FinTech Global said that this is positive news for the country as the regulations show that Singapore is willing to integrate Blockchain & Crypto into its financial ecosystem, unlike nearby countries such as China which have outright banned cryptocurrencies.

Advertise

Advertise