OCBC rolls out generative AI chatbot for employees, amongst world’s first

Over 4 million decisions in the bank are made by AI daily, OCBC shared.

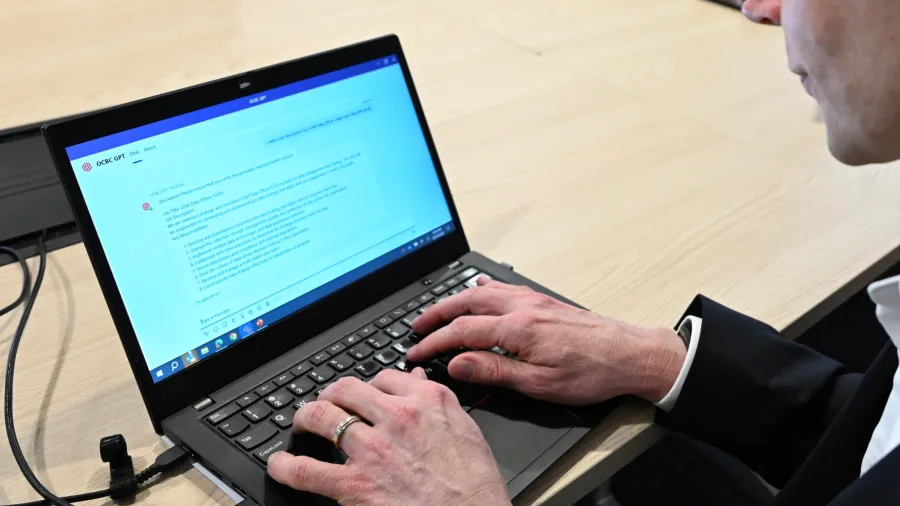

OCBC is deploying a generative artificial intelligence (AI) chatbot to its 30,000 employees globally in November.

This makes OCBC one of the world’s first-ever banks to roll-out generative AI tools at scale, the bank said in a press release.

Launched in collaboration with Microsoft’s Azure OpenAI, the generative AI chatbot is expected to assist employee with writing, research, and ideation.

A bank-wide roll-out has been set following a six-month trial period conducted between April to September 2023. About 1,000 OCBC staff across multiple functions have been testing the generative AI chatbot OCBC GPT in areas such as writing of investment research reports, translating of content in multiple languages and drafting of customer responses.

On average, participants of the trial had shared that they were able to complete their tasks about 50% faster than previously, OCBC shared. This included time taken to check OCBC GPT’s output to ensure factual accuracy.

ALSO READ: OCBC names new Greater China head, OCBC Wing Hang China CEO

Donald MacDonald, OCBC’s Head of Group Data Office, expressed excitement in being one of the world’s first banks to roll out generative AI tools at scale.

“We believe that these tools have the potential to transform the way our employees work by automating a wide range of time-consuming tasks, freeing up their time to focus on more strategic and value-added work,” MacDonald said in a press release announcing the new tool.

“This in turn helps us provide better customer service by spending more time building relationships with customers and developing innovative products and services,” he added.

Currently, more than four million decisions – in processes such as risk management, customer service and sales – are made by AI in the OCBC daily. This is projected to increase to 10 million by 2025.

Advertise

Advertise