News

Australia’s mortgage delinquency rate to rise in coming quarters

Australia’s mortgage delinquency rate to rise in coming quarters

It is beset with the same issues as of its peers: inflation and interest rates.

Citi names Aveline San as CEO of Hong Kong and Macau

San joined Citi in April 2019.

Weekly Global News Wrap: Credit Suisse China beset with senior staff exodus; Israel’s Bank Hapoalim optimistic with interest rate rise

And Tencent’s NFT platform to stop selling new NFTs.

Recovering business activity props up Thai banks’ revenues

Credit costs will remain elevated in the long-term, however.

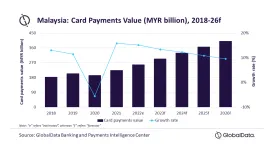

Malaysia’s card payment market value to grow 15.2% in 2022

A perfect storm for card adoption is brewing in the country.

China’s new bank loans plummet in July amidst COVID fare-ups, property jitters

Analyst warned that new lending may continue to disappoint in the near term.

Property woes, unemployment threaten structure letting Chinese banks offload bad loans

NPL securitisations allows banks to sell NPLs to a vehicle.

Dah Sing Bank temporarily closes its Maritime Square Branch

It will reopen in 13 August.

Grab unveils US$1m GrabScholar programme, new GrabMerchant Centre

The superapp aims to support small businesses and upskill the future workforce.

BOC HK, BOC Life launch green savings insurance plan

It offers up to a 3% annualised guaranteed rate of return at policy maturity.

Atome Financial secures US$100m debt facility with HSBC Singapore

It operates buy now pay later platform Atome and Indonesia’s Kredit Pintar.

Asset quality of South Korea’s big banks to remain supported as interest rate rise

But bad loans are expected to rise moderately.

India tightens rules for digital lending

Lenders may no longer increase credit limits without the consent of the borrower.

Maybank enables Singapore, Malaysia card users to link with ApplePay

This includes users of Mastercard and Visa credit, debit, and prepaid cards.

Dah Sing Bank temporarily closes Mei Foo Sun Chuen Branch

It will reopen on 11 August.

OCBC enables direct CPF account top-ups from digital app

This makes OCBC the first bank to enable this outside of the CPF website.

Dah Sing Bank temporarily shutters Shek Tong Tsui branch

Customers are advised to use mobile or internet banking services.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership