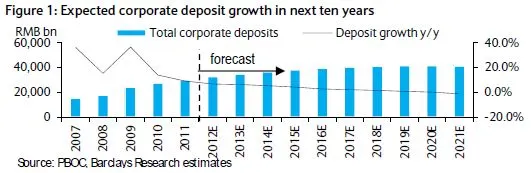

See how China's corporate deposit growth will deteriorate in 10 years

It is expected to decline to a negative growth in 2021.

According to Barclays, China is entering a low-growth era on organic growth analysis.

Here's more from Barclays:

We expect corporate deposit growth to be 7% in 2012E, gradually declining to slightly negative growth (-1%) in 2021E, on: 1) slower GDP growth; 2) lower operating cash flow profitability at Chinese corporates, due to economic slowdown, rising labor costs and less cash efficiency post the infrastructure-driven stimulus of 2008-09;

3) corporations diversifying into other financial investments from deposits; and 4) growth in base money (M1) supply to decrease amidst a declining trade surplus and forex purchases.

In addition, in our view, the likelihood of another big monetary expansion is low going forward, and potential capital outflow amid capital account liberalization could be managed by RRR.

Click the photo to enlarge.

Advertise

Advertise