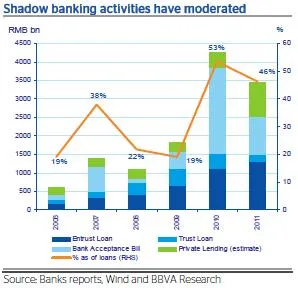

Shadow banking in China moderates

Looks like the regulations in 2011 were successful in reducing major risks by slowing shadow banking activities.

According to Le Xia, senior economist at BBVA Research, monetary policy tightening was accompanied by macro-prudential measures, mainly through strengthened banking regulations. "The new regulations have been broadly effective in moderating banking sector risks. Real estate loans as a share of total new loans slowed significantly, to 15% y/y in Q4 2011 from 33% y/y in Q1 2010, and the ratio of shadow banking activities to loans of the formal banking sector decreased to 46% in 2011 from 56% in 2010."

Advertise

Advertise