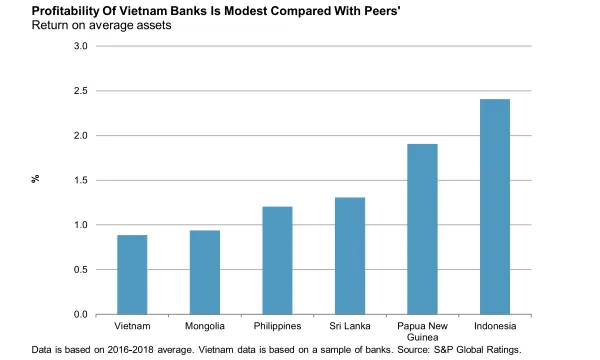

Chart of the Week: Check out Vietnamese banks' return on average assets

It lags behind the Philippines and Indonesia.

This chart from S&P Ratings shows that Vietnamese banks’ return on average assets came in at around 0.8% from 2016 to 2018. This is relatively lower compared to other Asian peers such as the Philippines (1.2%) and Indonesia (2.4%).

System-wide return on average assets in Vietnamese banks was recorded at 0.8% from 2014 to 2016, according to the firm. It grew to 0.9% in 2017 and to an estimated 1% by 2018. By 2019 and 2020, S&P ratings believe that the figures will hit 1%.

Also read: Vietnamese banks' return on assets up for second straight year

Despite a better year for profits, banks still face massive capital shortages estimated at around 9% of GDP to meet the Basel II requirements that will take effect in 2020. Moody’s had said in a previous report that banks could raise capital from foreign investors amidst the underdevelopment of the domestic capital market.

Advertise

Advertise