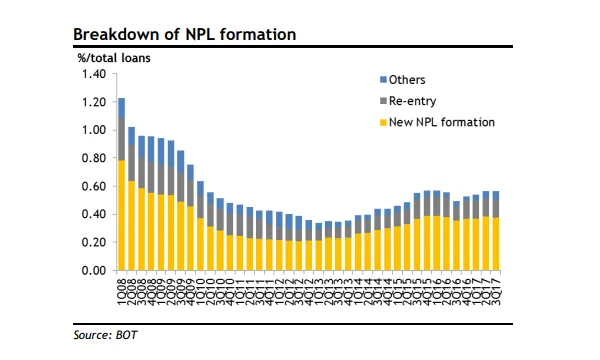

Chart of the Week: Here's the breakdown of Thai banks' NPL formation over 10 years

NPLs should stay flat in 2018.

Analysts at Maybank Kim Eng expect NPL ratio to be flat or fall just modestly for most Thai banks because: 1) despite improving new NPL formation, re-entry NPL/restructure loans will keep NPL formation at the current level; and 2) NPL resolution has been very slow in this cycle.

Here's more from Maybank Kim Eng:

Late last year, we anticipated that the NPL ratio would fall this year as improving economic growth should push down new NPL formation. Admittedly, it is only half- correct. Yes, new NPL formation has slowed as we expected.

But those NPLs that became performing loans fell back into NPL again (what we call re-entry or relapse). Perhaps the economic expansion is not strong or broadbased enough to strengthen those already-troubled borrowers.

Even though the economic growth should accelerate further this year, this picture should continue. Plus, restructured loans remain high for many banks (3.4% of loans at KBANK as of 3Q17, for instance) and most of them remain classified as normal loans. There will be more NPL from this category to come, in our view.

Advertise

Advertise