Chart of the Week: How open is Asia to branchless banks?

Approximately 55-80% of customers are considering opening an account in a digital-only bank.

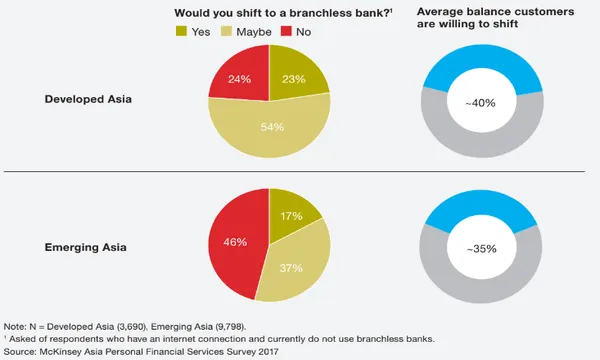

More than a third (40%) of customers in developed Asia are willing to shift to branchless or digital-only banks, according to a report from management consultancy firm McKinsey.

The openness of customers to digital alternatives without the need for a physical distribution network has been correspondingly met by the local market in developed Asia.

"Over the last three years, several new banking propositions have been launched across the Asia-Pacific region," McKinsey noted.

In Korea, for instance, Kakao launched Kakaobank to become the fastest-growing mobile bank in teh world with over 5.5 million users and $6b in deposits.

Emerging Asia isn't one to be left behind as 35% of customers have expressed willingness to shift to branchess banking, supported by a slew of fintech initiatives from major banking players. BTPN in Indonesia, for instance, launched Jenius, a standalone and first-to-market digital bank whilst Singapore's DBS has expanded its mobile-only digital bank in India in 2016 and to Indonesia in 2017.

Advertise

Advertise