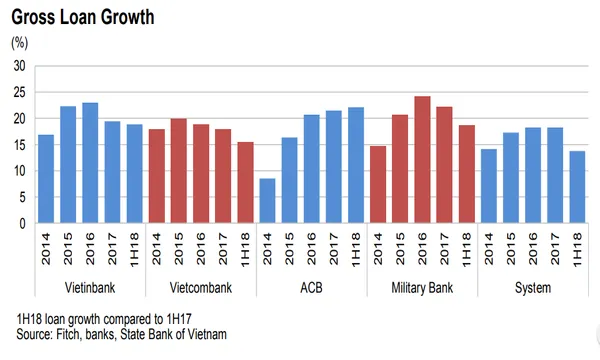

Chart of the Week: Vietnamese banks rapid loan growth moderates in H1

Retail and manufacturing loans drove H1 gains.

The rapid pace of lending by Vietnamese banks moderated to 18% YoY in the first half of 2018 but remained strong as retail and manufacturing loans drove half-year gains, according to Fitch Ratings.

The State Bank of Vietnam (SBV) earlier set a full-year credit growth target of 17% for end-2018, which has aggravated concerns of a capital shortage as loan growth continues to outpace capital production.

Also read: Capital crunch clouds Vietnamese banks stellar half-year profit results

Banks have been pursuing the high-growth retail segment which has helped reduce loan-concentration risk and improve yields. The shift is supported by the country's growing consumerism and improving sentiment in the domestic property market with Vietcombank's retail mix rising the most since 2014 as it targets retail loans to form half of its lending portfolio by 2020 from 36% by end-June.

"We expect the strong economy to continue to sustain rapid loan growth, especially in the retail segment," the rating agency said in a report.

The transition, however, could bring in a level of risky exposure as unrestrained growth in loans will be "credit negative", cautioned Fitch Ratings. "This has helped diversify the loan mix, with less exposure to state-owned enterprises – a positive, but risk appetite could grow as the banks jostle for market share. This could have an impact on credit quality if not properly monitored and controlled."

Advertise

Advertise